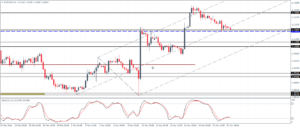

EURUSD Daily Analysis

EURUSD (1.12): EURUSD has closed a third consecutive session to the downside but the daily chart shows prices likely to remain above $1.120 lower support level briefly. A break below this going by the bearish momentum could see further downside in store but prices could bounce off the 1.120 handle on the first test of support. Below 1.12, 1.113 – 1.1105 support will be the next level of support to watch for, which could keep EURUSD biased to the upside.

USDJPY Daily Analysis

USDJPY (112.37): USDJPY has moved up and is currently trading at the ¥112.0 support level but a confirmation with a higher low is needed to validate the upside as ¥114.0 resistance is likely to cap the gains in the short term. Overall, the long-term view for a test to ¥117 remains on the cards. On the 4-hour chart, 112.50 will be the first level of resistance that needs to be cleared, following which a test to ¥114.7 – ¥114.35 is likely. To the downside, if ¥112.5 resistance holds, USDJPY could remain range bound within ¥111.31 while a break below this support could see the bearish trend resume.

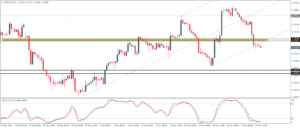

GBPUSD Daily Analysis

GBPUSD (1.41): GBPUSD has fallen to the 1.42 support following the doji candlestick pattern that was formed last Friday and this Monday’s bearish close. The daily chart shows the hidden bearish divergence with the oscillator forming a higher high against price’s lower high opening up room for further downside. With the support at $1.4263 being broken on the 4-hour chart, a pullback to this level could establish resistance, in which case GBPUSD could fall to the lower support at $1.4025 – $1.40.

Gold Daily Analysis

XAUUSD (1234): Gold prices are looking to move lower following yesterday’s rally back to $1250 handle. With prices being rejected at this level and the current bearish declines, Gold prices are likely to continue lower towards the $1200 support. In the short term, watch the support near $1230 – $1225, which if holds could see Gold bounce back but remain range-bound below the $1250 handle. Only a close back above the $1250 will shift the current downside bias to neutral.