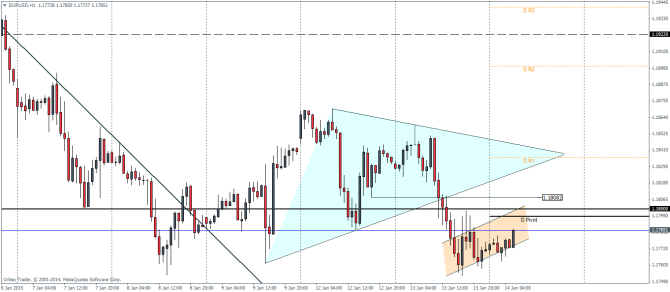

EURUSD Daily Pivots

| R3 | 1.1941 |

| R2 | 1.19 |

| R1 | 1.1835 |

| Pivot | 1.1794 |

| S1 | 1.173 |

| S2 | 1.1689 |

| S3 | 1.1624 |

EURUSD formed a consolidating triangle pattern after the upside breakout attempt from the falling trend line. The triangle pattern if successful on a retest to the breakout price point near 1.8082 could potentially see a rapid decline towards 1.1701 support levels. Price action is also currently shaping up to form a bearish flag after the breakout from the triangle pattern indicating downside pressure. The bearish flag pattern also points to a downside move towards 1.1701 point of confluence of the triangle’s price objective, a major horizontal support level and the bearish flag price objective.

An alternative view is for a bullish close above 1.8082. In such a scenario, we will need to see a confirmation of support being established at this zone and a close higher above 1.8155 which will make EURUSD very bullish, targeting 1.19 – 1.2 areas.

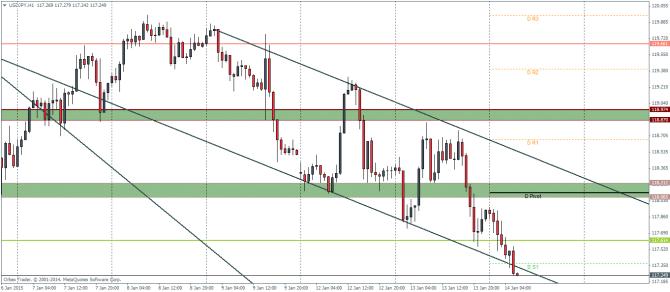

USDJPY Daily Pivots

| R3 | 119.961 |

| R2 | 119.403 |

| R1 | 118.667 |

| Pivot | 118.109 |

| S1 | 117.373 |

| S2 | 116.815 |

| S3 | 116.079 |

USDJPY has been moving within the falling price channel and price action is currently hovering near the lower support line of the price channel. We could therefore expect to see a moderate rally towards the broken support zone of 118.212 – 118.065, which also shows confluence with the daily pivot level. A rally to the daily pivot will then make way for further declines in the USDJPY. The bearish price action could eventually decline to as low as 116.

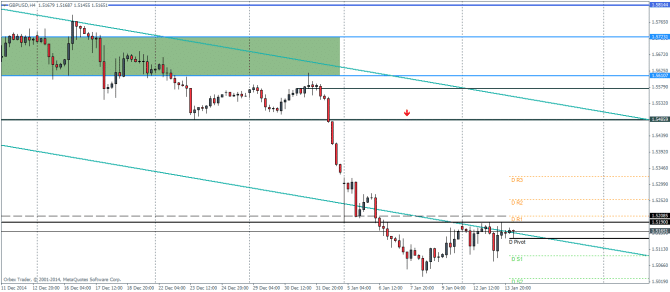

GBPUSD Daily Pivots

| R3 | 1.5321 |

| R2 | 1.5256 |

| R1 | 1.5208 |

| Pivot | 1.5143 |

| S1 | 1.5093 |

| S2 | 1.5028 |

| S3 | 1.4979 |

GBPUSD managed to erase the losses from the intraday news release of CPI and managed to close higher from yesterday’s lows. The cable is most likely to continue its upward correction as we maintain the corrective rally to go as high as up to 1.5486 to test the broken support level for resistance before resuming its bearish decline overall.