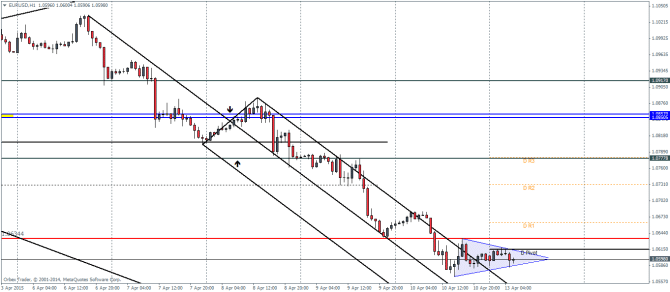

EURUSD Daily Pivots

| R3 | 1.0779 |

| R2 | 1.0731 |

| R1 | 1.0663 |

| Pivot | 1.0615 |

| S1 | 1.0547 |

| S2 | 1.0499 |

| S3 | 1.04313 |

EURUSD continues it descent after the major support at 1.06344 was broken. Price action has printed a bearish triangle, a continuation pattern that could see further downside moves in the EURUSD. The next major support for EURUSD comes at 1.05068 levels, but the test to this level comes from outside of the median line which could indicate that a potential bounce to the upside is likely, which could see a retest back to 1.06344.

If price action fails in its move to the downside, EURUSD could attempt to break above 1.06344 which paves way for a test to 1.0777.

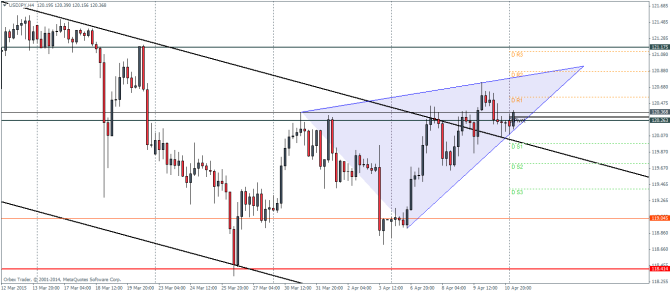

USDJPY Daily Pivots

| R3 | 121.122 |

| R2 | 120.871 |

| R1 | 120.553 |

| Pivot | 120.302 |

| S1 | 119.978 |

| S2 | 119.727 |

| S3 | 119.409 |

USDJPY has been consolidating, forming a triangle/ascending wedge pattern, this indicates a potential downside move is likely. However, a break below 120.263 is essential to anticipate any moves to the downside. There is also the trend line from the falling price channel that could act as support. Regardless, a break out from the ascending wedge could see USDJPY drop lower towards 119.045, the initial support level. Only a break above the recent highs at 120.7 will see a continuation to the upside.

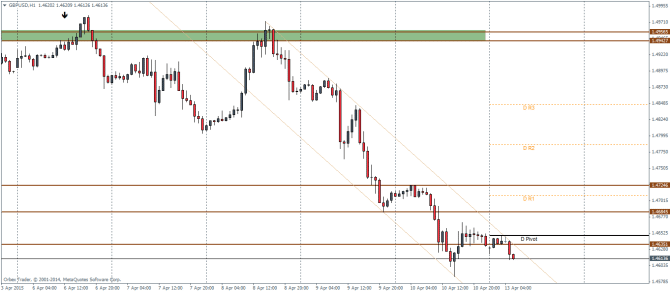

GBPUSD Daily Pivots

| R3 | 1.4847 |

| R2 | 1.4786 |

| R1 | 1.4709 |

| Pivot | 1.4645 |

| S1 | 1.4572 |

| S2 | 1.4511 |

| S3 | 1.4434 |

GBPUSD eventually broken down below 1.475 levels and briefly tested the levels to 1.472 for resistance before declining further to 1.4635. Price has been trading within a falling channel and currently looks to have stalled near 1.4635. Further declines could be in store for GBPUSD unless we see a breakout from the price channel, that could attempt another test to 1.468.