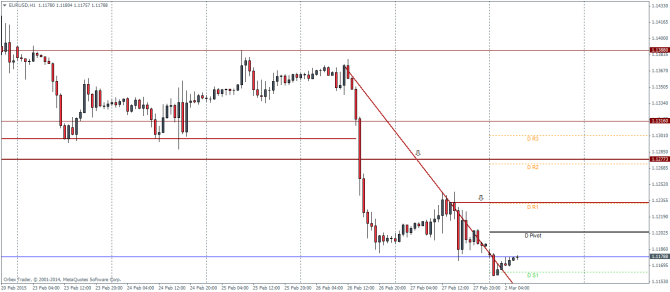

EURUSD Daily Pivots

| R3 | 1.1301 |

| R2 | 1.1273 |

| R1 | 1.1232 |

| Pivot | 1.1203 |

| S1 | 1.1163 |

| S2 | 1.1134 |

| S3 | 1.1093 |

EURUSD is currently looking to ease from its session lows of 1.1159 levels having broken a minor trend line. The first resistance comes in at 1.1233 levels, which if holds could see EURUSD look for more declines. Alternatively, a break above 11233 could see a retest back to 1.12773 to retest the broken support level. EURUSD price action looks quite bearish and any upside gains in the short term are likely to be capped at the noted resistance levels.

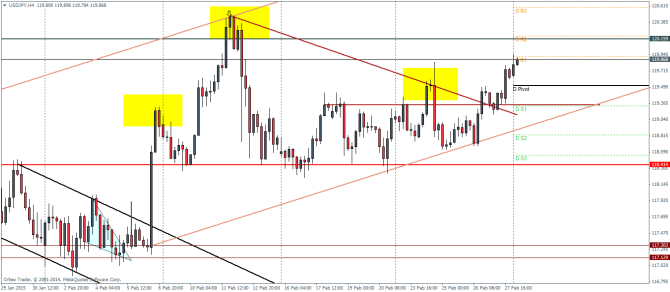

USDJPY Daily Pivots

| R3 | 120.588 |

| R2 | 120.194 |

| R1 | 119.908 |

| Pivot | 119.507 |

| S1 | 119.228 |

| S2 | 118.827 |

| S3 | 118.548 |

USDJPY invalidated the potential head and shoulders pattern and the break out from the smaller trend line is indicative of a move to the upside. We expect a possible retracement down to 119.25 levels targeting 120.16 levels. A break above 120.16 would then see USDJPY aim for 121 levels on the upside. If 120.16 does manage to hold prices, we will then need to watch for a break out from the wider rising price channel before we can expect weakness and a downside rally in this pair.

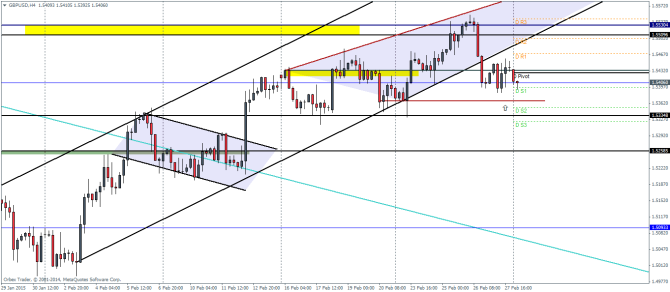

GBPUSD Daily Pivots

| R3 | 1.5543 |

| R2 | 1.5501 |

| R1 | 1.5469 |

| Pivot | 1.5427 |

| S1 | 1.5395 |

| S2 | 1.5352 |

| S3 | 1.5322 |

After breaking out from the rising wedge/triangle pattern, GBPUSD managed to retrace to the break out level before edging lower. The current downside remains at 1.5367 through 1.5335 levels. If this support holds, GBPUSD could possibly see a rally testing the resistance at 1.5432 first followed by 1.553 levels to the upside. Only a break above 1.553 will see a further rally to the upside. Alternatively, if the resistance levels holds, GBPUSD could enter a consolidation phase before establishing its near term bias.

In this week’s podcast, we cover Yellen & the hike, AUD & CAD rate previews, Jobless claims vs. USD & Greek back burner

Subscribe to our iTunes page