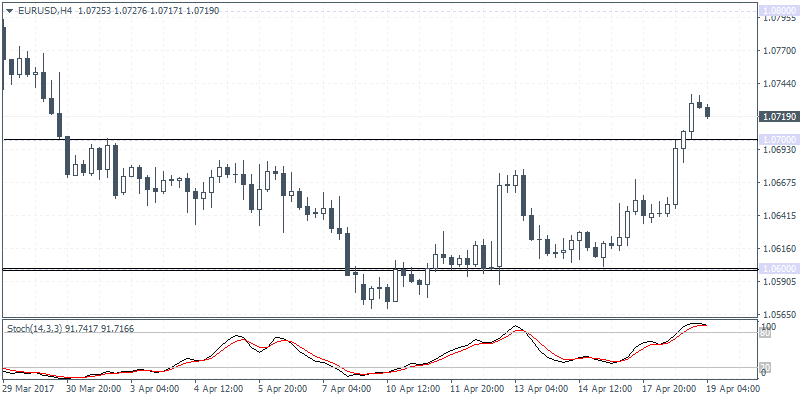

EURUSD intra-day analysis

EURUSD (1.0719): EURUSD is currently moving counter trend after prices fell to 1.0600 last week. After consolidating near this level, EURUSD posted two days of strong gains as price action was seen clearing the 1.0700 resistance level yesterday. Any pullbacks will likely see 1.0700 being tested in the near term, ahead of what could be a strong rally towards 1.0800 where resistance is most likely to be tested in the near term. Following the rally to 1.0800, we expect EURUSD to remain range bound within 1.0800 and 1.0600 into this weekend’s French elections.

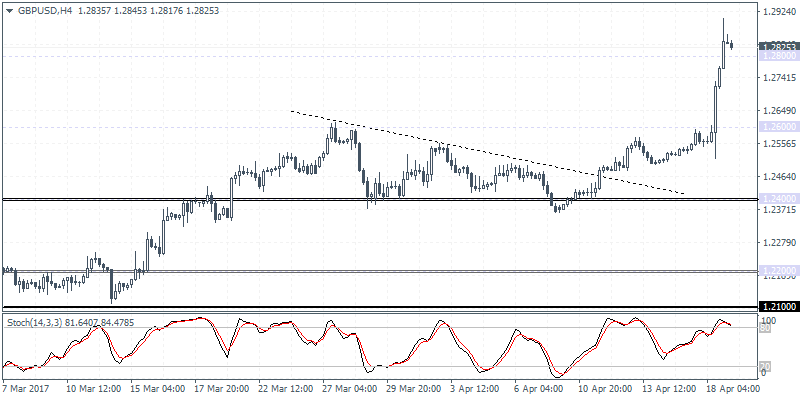

GBPUSD intra-day analysis

GBPUSD (1.2825): The British pound has posted strong gains after prices were stuck near the 1.2400 support level The rally yesterday sent GBPUSD to breach past 1.2600 and 1.2800 levels, marking a 6-month high in prices. On the 4-hour chart, the gains came following an upside breakout from the descending triangle pattern where support was formed at 1.2400. Any pullbacks could be seen touching down to 1.2600, which marks the resistance level that was previously held. Establishing support here could pave the way for GBPUSD to test 1.3000 in the near term.

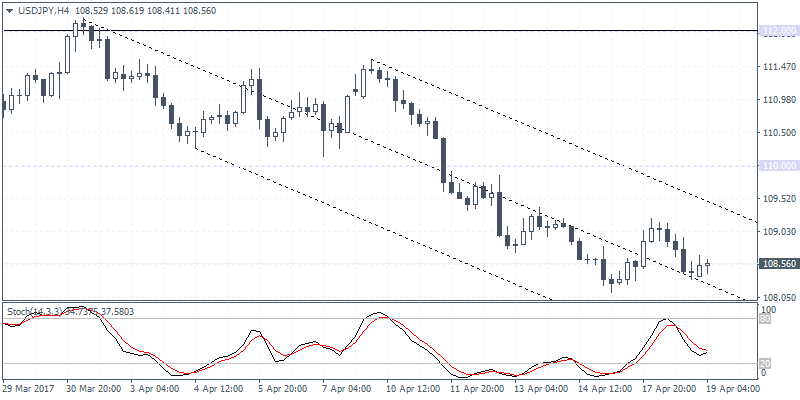

USDJPY intra-day analysis

USDJPY (108.56): USDJPY could be looking to post a relief rally with the prices currently seeing making a modestly higher low. However, the price will have to clear out the previous lower high formed at 109.20. A break out above 109.20 will confirm a move towards 110.00 at the very least which will mark a retest of the broken support level when resistance will also be established. Alternately, failure to clear 109.20 could signal further downside on a breakdown from the previous lows post at 108.30.