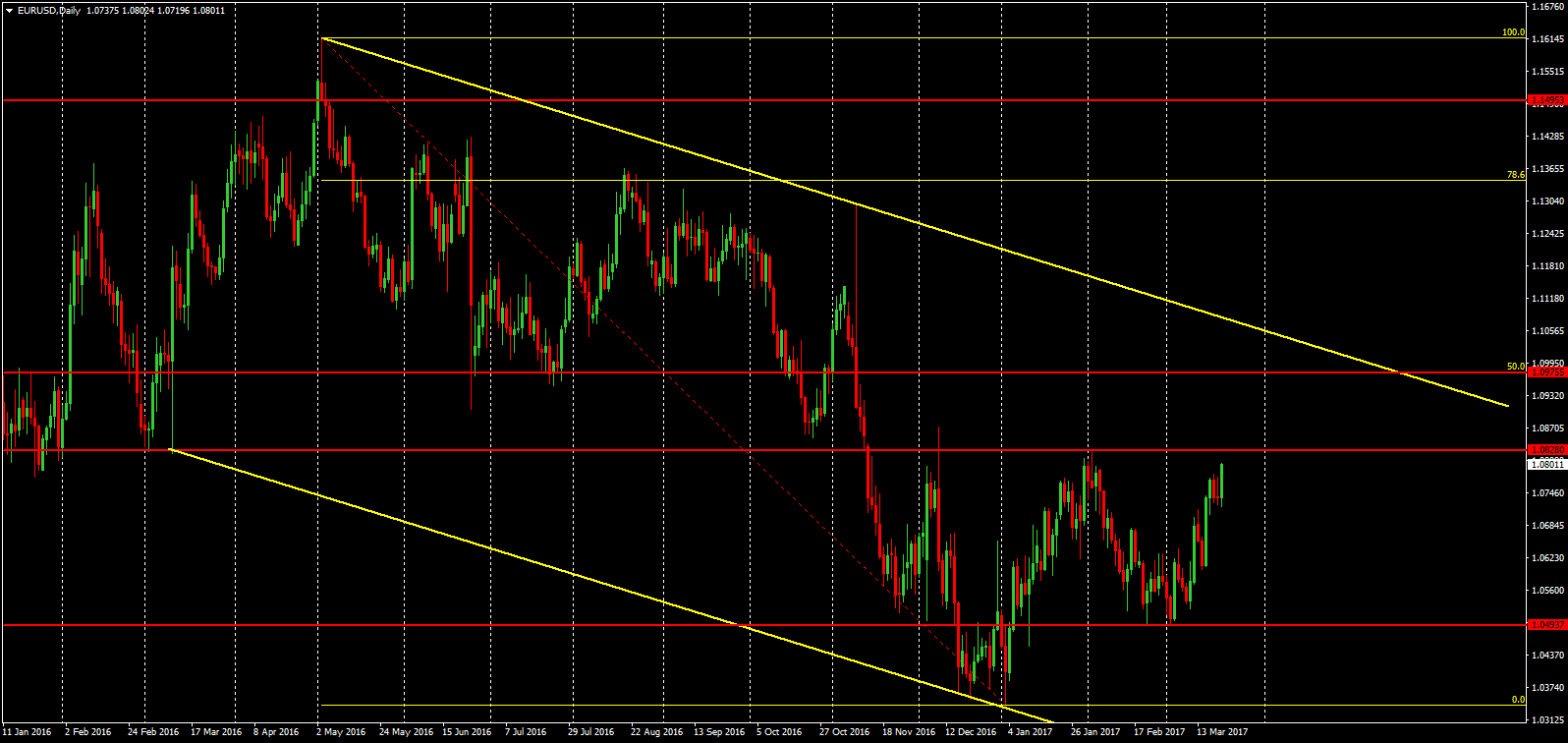

EURUSD

Price consolidated yesterday as directional catalysts have subsided in the wake of the ECB/ FOMC meetings. Local resistance at the January high of 1.0828 is the first challenge. Above their puts the focus on the bigger technical level of 1.0975 which is the 50% Fibonacci retracement from last year’s high. We also have the completion of an ABCD symmetry pattern at the level as well as bearish channel resistance in the area also. Will be monitoring price action around that level for short opportunities. Support sits below market at the 1.0490s level which is the Feb & March lows.

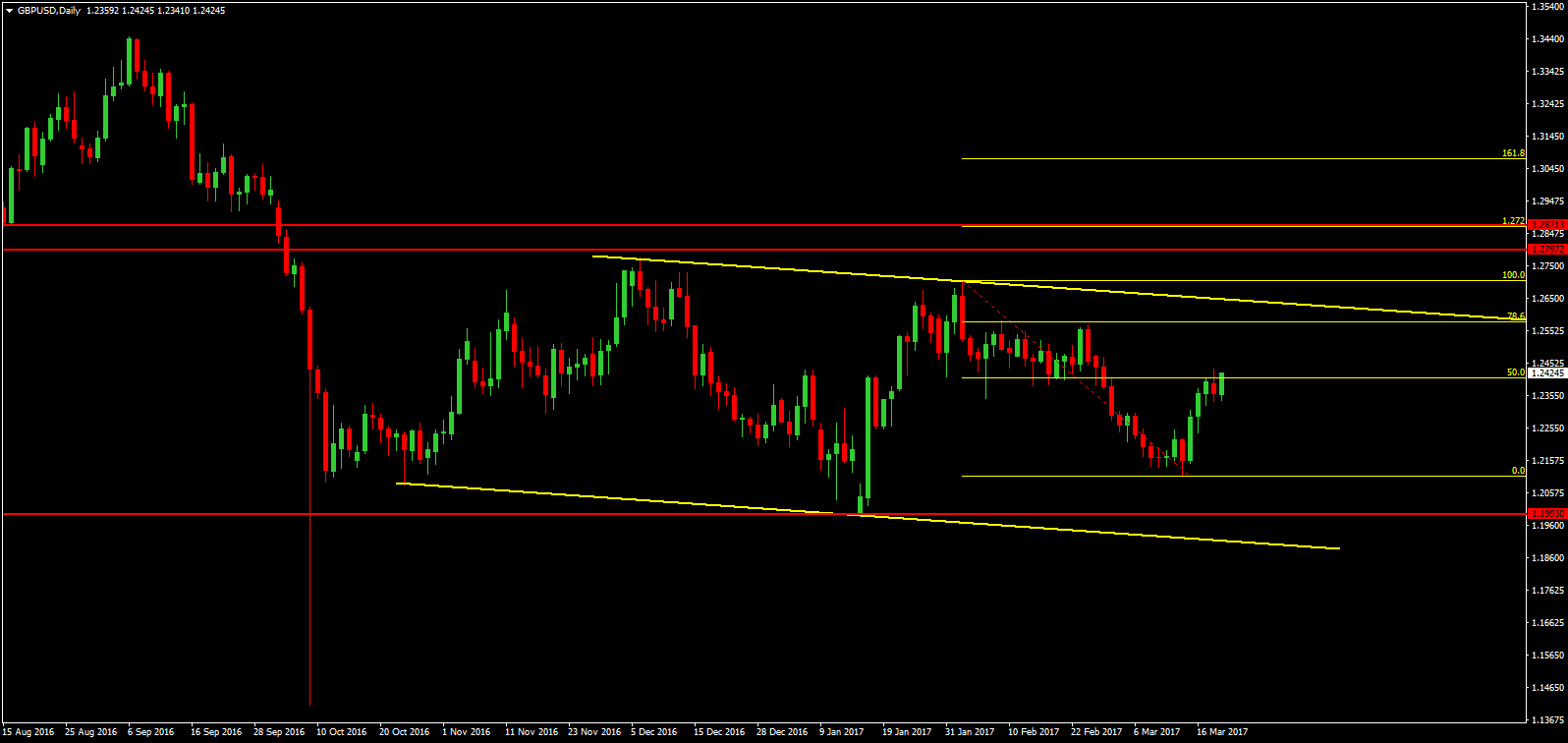

GBPUSD

The government’s confirmation of a date to officially trigger Article 50 (March 29th) fuelled a sell-off in GBP. Today focus will be on the Feb CPI data, expected to print strongly. For now, price is stalled at the 50% retracement from year-to-date highs ahead of bearish trend line resistance with stronger resistance sitting just above at the 1.2797/1.2871 area. Support sits below market at the 1.1993 level which is the year to date low, with bearish channel support just below.

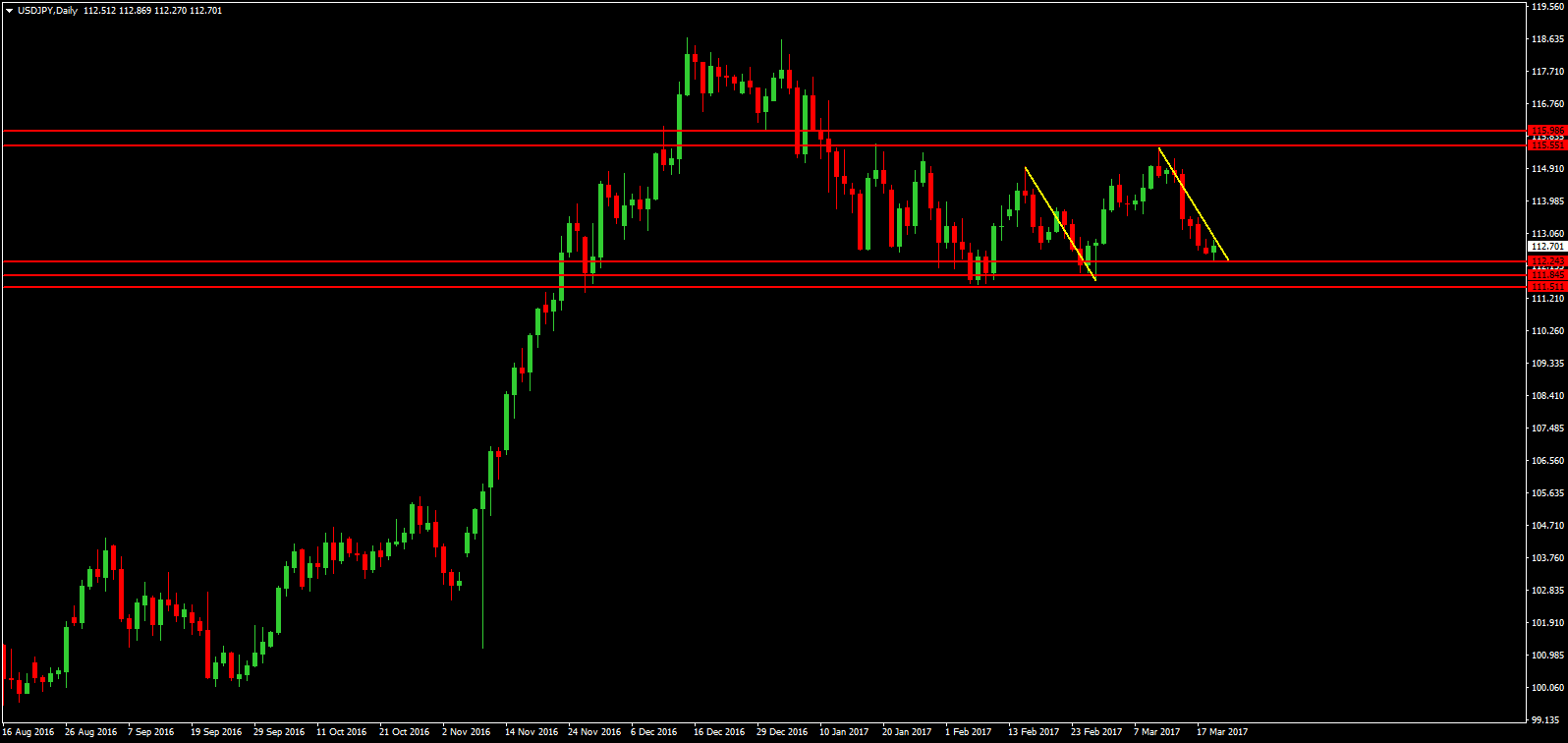

USDJPY

USD continued to weaken yesterday as markets continue to digest the FOMC and alter positions accordingly. Price is currently holding at symmetry support at the 112.24 level, just ahead of key structural lows, which should provide support for a rotation higher.