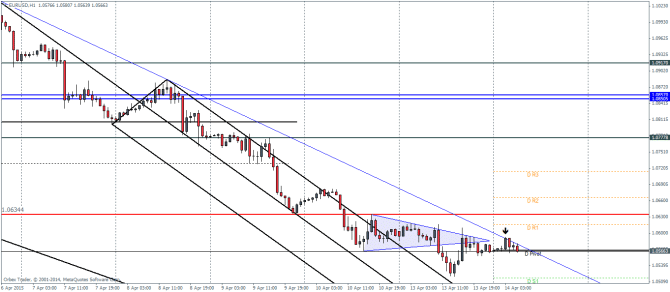

EURUSD Daily Pivots

| R3 | 1.0715 |

| R2 | 1.0666 |

| R1 | 1.0616 |

| Pivot | 1.0567 |

| S1 | 1.0517 |

| S2 | 1.0468 |

| S3 | 1.0418 |

EURUSD was seen consolidating for the most part just below the triangle pattern yesterday. The currency pair attempted a breakout from the triangle but failed to do so as prices are now capped near the trend line which is drawn using the median line reference points. Failure to break above the median line could see the Euro plummet lower with the first targeting being yesterday’s low at 1.0519 followed by a support at 1.0423, which shows a confluence of the median line and the daily support level.

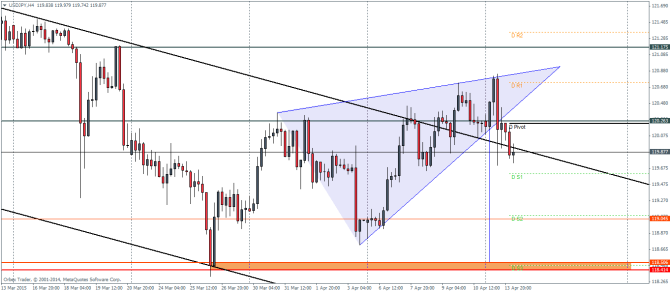

USDJPY Daily Pivots

| R3 | 121.88 |

| R2 | 121.358 |

| R1 | 120.739 |

| Pivot | 120.227 |

| S1 | 119.608 |

| S2 | 119.086 |

| S3 | 118.467 |

USDJPY finally managed to break down from the ascending triangle/wedge pattern and if valid, could see a drop down to 118.5 levels. Price action is seen trading back within the falling price channel, after the previous attempt to break out from the triangle failed. Resistance is now back at 120.6 and if this level holds, USDJPY could see declines later today, albeit a retest back to 120.6 cannot be ruled out. Alternatively, a break and retest of 120.6 for support will be the first clue for any upside moves.

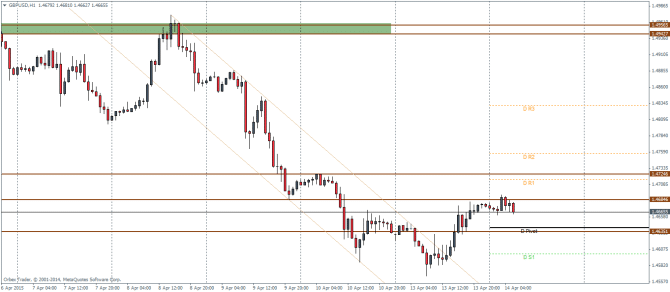

GBPUSD Daily Pivots

| R3 | 1.4831 |

| R2 | 1.4756 |

| R1 | 1.4715 |

| Pivot | 1.4640 |

| S1 | 1.46 |

| S2 | 1.4525 |

| S3 | 1.4484 |

GBPUSD broke out from its steep descending price channel but saw the rally hold near the previous support, turned resistance at 1.4684. A dip to 1.4635 is very likely which will then give further clues into price action. Most likely, GBPUSD could see another attempt towards 1.468, which if gives way could see a rally towards 1.4724 levels. To the downside, if 1.4635 fails, we could expect GBPUSD to resume its downtrend further.