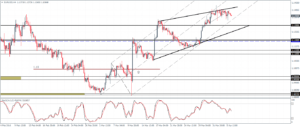

EURUSD Daily Analysis

EURUSD (1.13): EURUSD continues to form small bodied candlesticks near the top end of the recent rally. The current pause is likely to see some consolidating ahead of the uptrend being resumed. 1.130 broken resistance could be tested for support ahead of further upside to 1.147 while a dip below 1.13 could see EURUSD test the lower support at 1.120. With prices breaking out from the modest rising wedge pattern, we can expect the dip to 1.13 with further downside likely on a break below this resistance and a continuation to the downside.

USDJPY Daily Analysis

USDJPY (110.3): USDJPY continues its bearish trend with rather a strong momentum. Prices remained biased to the downside with a close below 110.672 yesterday, and any potential upside moves in prices could be met with resistance. To the downside 110.5 will be the next level of interest ahead of a longer-term decline to 109.5 region. It is ideal to keep an eye on the daily candlesticks for indication of any potential pullbacks to the current declines.

GBPUSD Daily Analysis

GBPUSD (1.41): GBPUSD is now trading below the minor resistance of 1.426 – 1.424. Yesterday’s price action erased the gains from the previous day with a bearish engulfing indicating a continued downside in prices. Any pullbacks are likely to see the broken support/resistance at 1.426 – 1.424 being retested ahead of further declines towards 1.4025 – 1.40.

Gold Daily Analysis

XAUUSD (1228): Gold prices are looking to move up again following yesterday’s bearish close. So far price action has formed a bullish engulfing pattern, but a daily close will confirm this bias. The new rising median line on the chart shows Gold back at one of the support/resistance levels, currently in the 1230 – 1225 zone. A break higher will see further upside to the 1243 – 1237 zone. Overall, Gold prices are likely to stay limited below 1250 and 1215 levels.