EURUSD Daily Analysis

EURUSD (1.115): EURUSD reversed the declines and closed back above 1.110 with prices seen testing 1.115 earlier today. Quite likely that EURUSD could remain range bound within the stronger resistance of 1.120 and 1.110 support in the near term. The bias remains to the downside, with 1.110 price level likely to be tested once again for further declines to 1.10. To the upside, a close above 1.115 could signal sideways pattern within 1.120 and 1.115. Further gains can be expected only on a strong close above 1.120 – 1.1240.

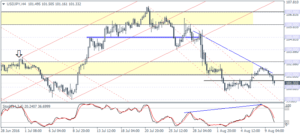

USDJPY Daily Analysis

USDJPY (101.33): USDJPY is currently seen testing the 102 support level and trading near the previous lows formed at 101. A daily close below 101 with conviction could see USDJPY turn weaker for a move back to the 100 level. On the 4-hour chart, following the hidden bearish divergence, price action is currently showing a bullish divergence that is still evolving. A higher low on the Stochastics is required for USDJPY to post a correction to the upside, following price reversal near 102 – 101.55.

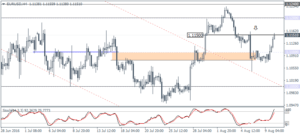

GBPUSD Daily Analysis

GBPUSD (1.306): GBPUSD fell to 1.30 and is seen bouncing off this level. The upside momentum could signal a move to retest 1.32 which marks the breakout level from the symmetrical triangle formed on the daily chart. On the 4-hour chart, price action shows GBPUSD moving within a falling wedge pattern that is still evolving. Expect some near-term consolidation ahead of a retest to 1.32 to establish resistance.

Gold Daily Analysis

XAUUSD (1350.39): Gold prices reversed the previous losses with price rallying back to the 1350 handle. This marks a retest of the breakout from the rising median line, although we can expect price action to possibly rally towards 1355 – 1356 region. The bias remains to the downside, however, but this view could change if price continues to rally above 1355 – 1356. To the downside, 1341 – 1340 remains a key support level that needs to be cleared for any expectations of a correction to the downside towards 1327.50.