EURUSD Daily Analysis

EURUSD (1.1232): EURUSD closed in a doji with an inside bar yesterday with prices turning flat on the day. EURUSD could remain directionless as noted in yesterday’s commentary but ECB President Draghi’s speech today could help see the euro build some momentum. On the 4-hour chart, prices are seen bouncing off the lower median line, and we suspect further upside that could send EURUSD back to testing the resistance at 1.1280 – 1.1270 more firmly. Establishing resistance here could signal further downside, with 1.1200 acting as the initial support with declines likely to accelerate on a break below this support level. Alternately, a daily close above 1.1280 could signal further upside with 1.1341 coming in as the next main resistance level.

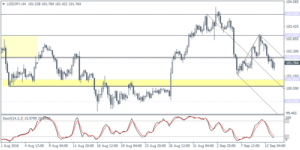

USDJPY Daily Analysis

USDJPY (101.76): USDJPY is seen consolidating near the 102.00 support level for the past few daily sessions, and the rather flat price action could continue into next week’s BoJ meeting. On the 4-hour chart, prices are seen testing the 102.00 price level while support at 101.00 – 100.80 remains yet to be tested. Establishing support at 101.00 – 100.80 could confirm near-term strength in the USDJPY, however, a breakout above 102.00 could see USDJPY move into a sideways pattern within 103.00 resistance level.

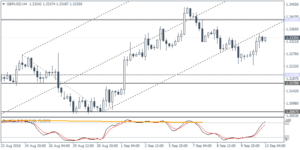

GBPUSD Daily Analysis

GBPUSD (1.3335): GBPUSD formed an outside bar with a bullish close yesterday, but the price action could stay limited near 1.3400 resistance level. On the 4-hour chart, we see prices retracing the declines. Establishing resistance at 1.3400 could see a lower high being formed confirming the decline towards 1.3200 – 1.3170 support. UK’s inflation data could be the main event risk for GBPUSD today. Further upside can be expected only on a close above 1.3400, in which case, GBPUSD could resume its uptrend.

Gold Daily Analysis

XAUUSD (1330.66): Gold prices formed a doji close yesterday coming after three straight days of declines. Prices are still struggling near the 1330 support level, but a close above this level could signal further upside in prices. The decline, seen yesterday was held near the 1331 – 1327.50 support level which marks the right shoulder. A continuation to the upside from this support could see gold prices retest 1350 – 1356 level and could potentially keep gold biased to the upside. A break below 1330 – 1327.50 support could, however, signal near-term weakness with 1314 – 1312 acting as the next support.