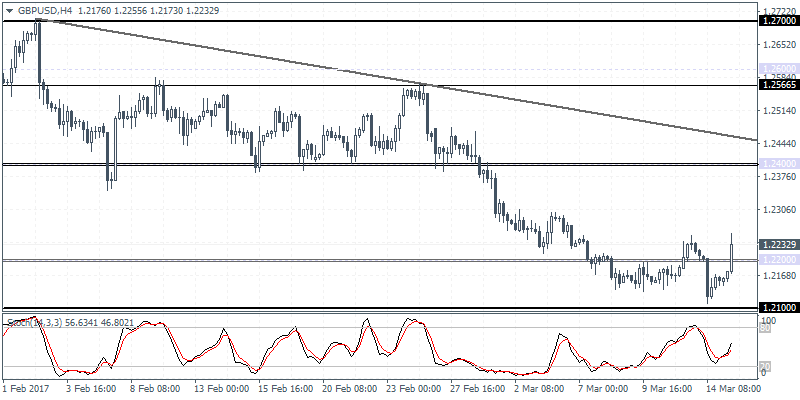

EURUSD intra-day analysis

EURUSD (1.0619): EURUSD is likely to test the support at 1.0600 more firmly today although the current price action is showing signs of bullishness. A firm retest off 1.0600 could indicate upside bias in the single currency targeting 1.0700 with further continuation coming on a breakout above the previous high. To the downside, a close below 1.0600 could signal a decline towards 1.0532 – 1.0521 support level. However, the 4-hour Stochastics is currently pushing higher which could indicate a possible move to the upside. Expect EURUSD to remain range bound within 1.0700 and 1.0600 levels into the FOMC meeting.

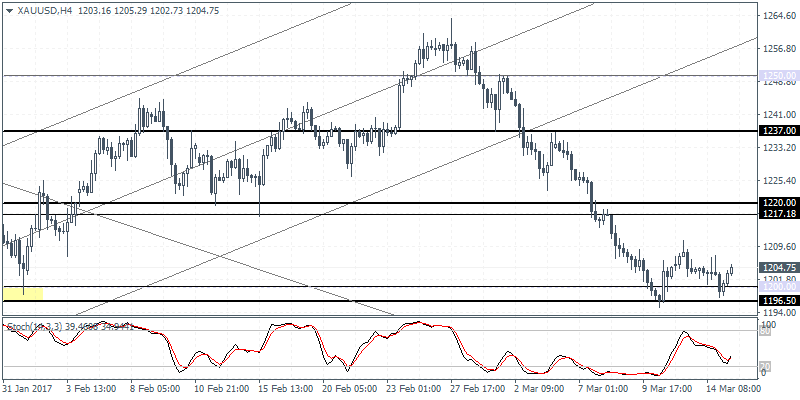

GBPUSD intra-day analysis

GBPUSD (1.2232): The British pound is seen posting a recovery after slipping close to the support at 1.2100 yesterday. The declines came about as the Scottish National Party laid out plans for holding a second independence referendum earlier this week. The news sent GBPUSD tumbling below 1.2200 price level. In early trading session today, the GBPUSD was seen strengthening breaching past 1.2200 price level yet again. However, the cable could be seen coming under pressure ahead of today’s FOMC decision and the BoE’s meeting tomorrow.

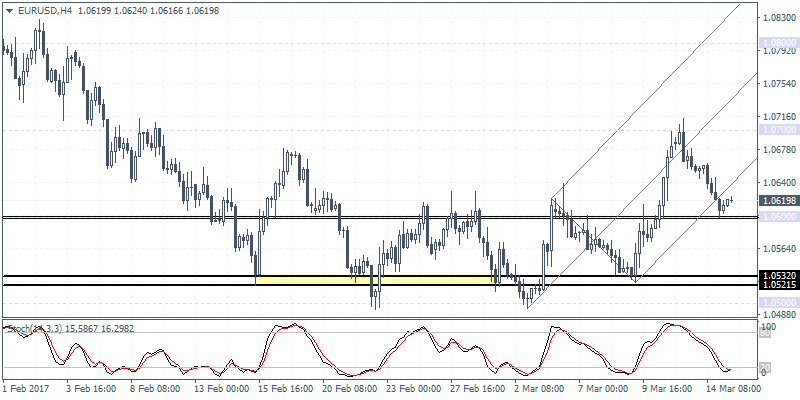

XAUUSD intra-day analysis

XAUUSD (1204.75): Gold prices slipped below 1200.00 but managed to post a strong reversal over the past 12-hours. This could indicate a near-term upside bias with gold prices likely to test 1217 – 1220 resistance as seen on the 4-hour chart above. With the central bank poised to hike rates for the third time ahead of today’s FOMC vote comes the consumer price index data which could be seen strengthening further. The precious metal is also likely to be supported by the developments from Europe which include the political developments in the UK as well as the Netherlands elections that are currently underway.