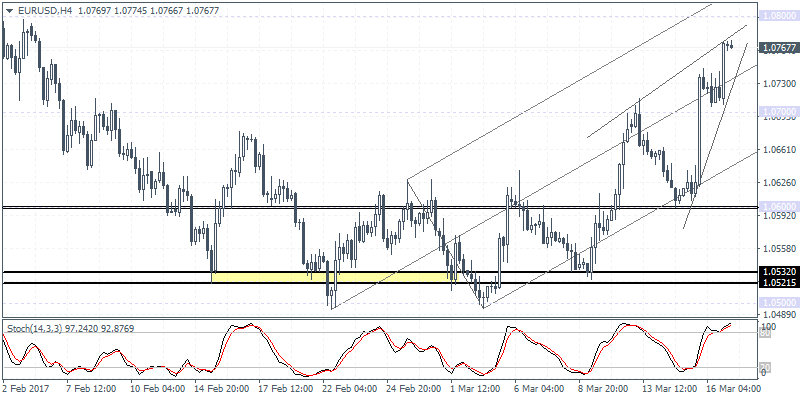

EURUSD intra-day analysis

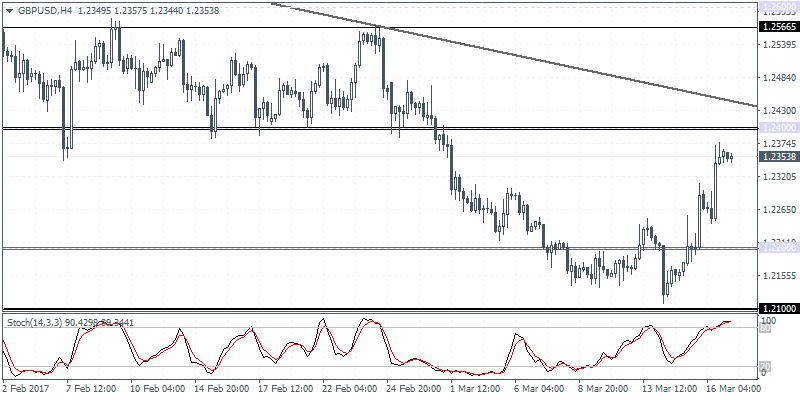

GBPUSD intra-day analysis

GBPUSD (1.2353): GBPUSD posted the second day of strong gains yesterday, but the rally is quite likely to be short lived as price approaches the resistance level of 1.2400 which is pending a retest. The gains in GBPUSD came about on the dissenting vote from the BoE’s monetary policy meeting yesterday. But in the backdrop of Brexit negotiations, it is unlikely for GBPUSD to maintain the gains. Following the break down below 1.2400 which previously acted as support, GBPUSD extended the declines to 1.2109 before posting a reversal. If resistance is established at 1.2400, then we can expect to see further declines coming for GBPUSD to test the support level at 1.2100 more firmly.

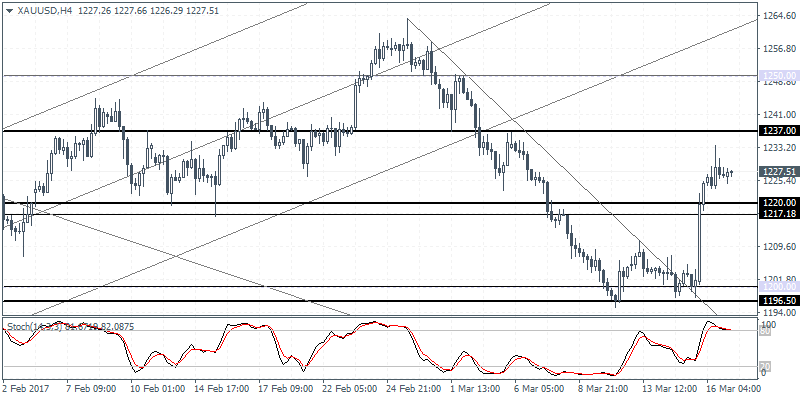

XAUUSD intra-day analysis

XAUUSD (113.25): Gold prices continued to rally for the second day after the FOMC meeting. The price touched an eight-day high at 1233.66 yesterday before pulling back lower to close the day at 1226.45. Resistance is seen at 1240 – 1235 level on the daily chart which indicates near term sideways range with support seen at 1200.00. On the 4-hour chart, gold prices could continue rising towards the support/resistance price level of 1237.00 following which we can expect to see a pullback towards 1220.00.