The euro is under pressure following Draghi’s press conference, where he left all the options open for December. The team at Deutsche Bank sees pressure on EUR/USD and also EUR/JPY:

Here is their view, courtesy of eFXnews:

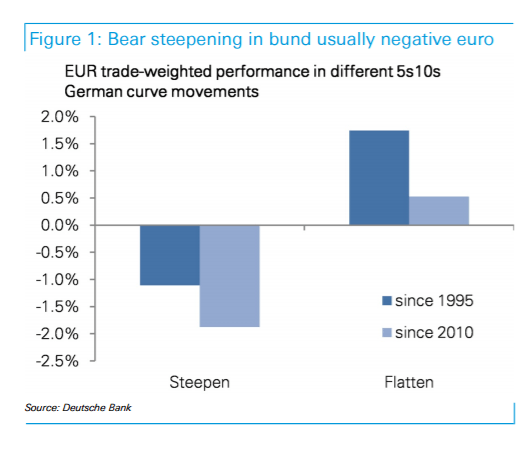

The euro is already close to fair value on real rate differentials and not suggesting any particular divergence versus shortterm cyclical drivers. The recent US fixed income sell-off has been about higher breakevens and steeper curves, neither of which have been material positive dollar drivers in the past.

We’ve got a bearish 1.05 EUR/USD forecast by the end of the year but we expect this to be a gradual grind lower more reliant on the Fed eventually delivering a rate hike and continued European portfolio outflows (Euroglut) rather than any major ECB surprise.

We prefer holding EUR/JPY shorts

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.