EUR/USD is trading around the post-Brexit highs after making a nice break. What’s next for the pair? Here are two opinions:

Here is their view, courtesy of eFXnews:

EUR/USD Will Reach 1.20 Before It Reaches 1.00 – Danske

Growth. US growth surprised on the downside in Q2, but recent labour market data has surprised on the upside. Private consumption should be supported in coming months despite the weak July retail sales. European data have been stronger than we expected given Brexit, but the sharp slowdown in the UK is likely to impact the eurozone with a lag. As such, we hope to see some softness in European data in the coming months.

Monetary policy. The Fed was slightly more hawkish than expected at its July meeting. Fed chair Janet Yellen is likely to give more clarity on her thinking regarding monetary policy in her Jackson Hole speech on 26 August. We believe that the Fed will wait until H1 17 to raise interest rates again. The market is pricing around 40% probability for a 25bp rate hike before end- 2016 which appears fair. Meanwhile, we expect that the ECB as a minimum will have to extend its QE purchases beyond March 2017, but it is unlikely that it will cut interest rates further.

Flows. The market is short EUR/USD according to IMM data but not in stretched territory. As such, this increases the sensitivity of the cross to any impetus from relative rates.

Valuation. Both our PPP and MEVA models suggest the mid- 1.20s are ‘fundamentally’ justified and thus that the cross remains undervalued.

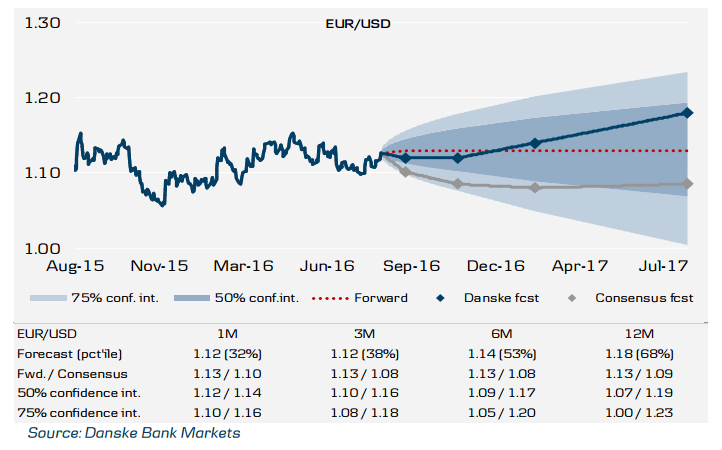

Forecast: 1.12 (1M), 1.12 (3M), 1.14 (6M), 1.18 (12M).

Risks. Political risks in the eurozone and in the US will weigh on markets in coming months. However, this can be both EUR and USD negative.

Conclusion. We are adjusting up our EUR/USD forecasts to 1.12 in 1M (from 1.09) 1.12 (1.07), 1.14 (1.10) and 1.18 (1.14). These are the forecasts we had before Brexit. Brexit has not had the economic impact on the euro zone as we expected. While we believe that there will be some slowdown in the euro zone in coming months, we still do not expect that the ECB will cut rates. Political uncertainty could weigh on both the EUR and the USD.

We maintain our long-held view that the undervaluation of the EUR and the wide eurozone-US current account differential are longer term EUR positives. Hence, EUR/USD will reach 1.20 before it reaches 1.00.

EUR/USD: Wide Limits M/T, Sub-Range S/T – SocGen

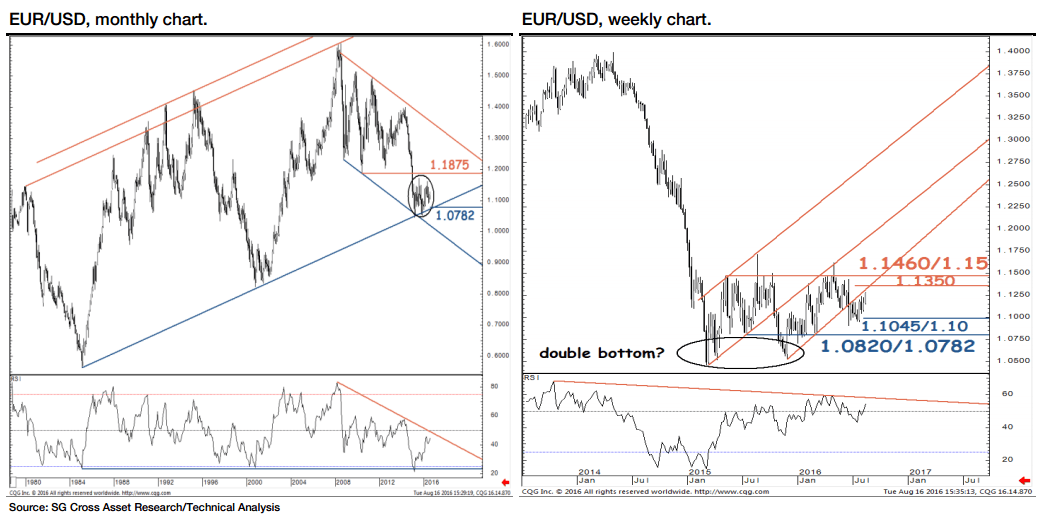

Having undergone a steady downtrend until last year, EUR/USD came up against crucial support at a multi-decade channel limit which currently stands at 1.0820/1.0782. Since then a pause is under way, and the pair has been witnessing a broad range bound-configuration.

The upside has so far remained constricted by graphical levels of 1.1460/1.15 which has acted as resistance last May, October as well as in April this year.

On the other hand, February low of 1.0820/1.0782 has acted as crucial support. Medium term, these form broad limits for EUR/USD.

The pair could be evolving within a double bottom however so long as 1.1460/1.15 remains unchallenged; it could just be a phase of consolidation within the down move. Within aforementioned larger limits, short-term price action has remained intertwined within a sub-range which is defined by 1.1045/1.10 and 1.1350, the 61.8% retracement from May and an upward trend drawn since last November.

Post-Brexit, EUR/USD has been developing a choppy recovery along this line. A similar trend provided resistance earlier this year during February and May.

Very short term, the pair has pierced above recent highs and a mildly ascending channel on hourly chart (1.1250/1.1220 levels). However 1.1350 and more significantly 1.1460/1.15 will remain next critical hurdles. 1.1250/1.1220 provides immediate support. In case this gives way, the pair will drift towards the up sloping trend at 1.1130 and perhaps even 1.1045, with intermittent support levels at 1.1190.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.