EUR/USD is trading at 1.1240 1.1263, the highest level since June 24th, the day after the EU Referendum – Brexit. The pair is about 50 pips higher on the day, above the previous highs seen earlier this month.

The past move higher did not survive more than a day, and the pair returned to the previous frustrating range. Is this break for real? It is not the first time we asked this question and there is no easy answer with this currency pair.

Why is it rising this time? This is an easier question. The move higher is driven by the weakness of the US dollar. As some European traders return to their desks after a holiday yesterday, the echoes of Friday’s poor retail sales report still weighs on the US dollar.

In Europe, we will later get the German ZEW business survey. This is expected to show that a bounce in confidence in August, after a post-Brexit fall in July.

See how to trade the German ZEW Sentiment with EUR/USD

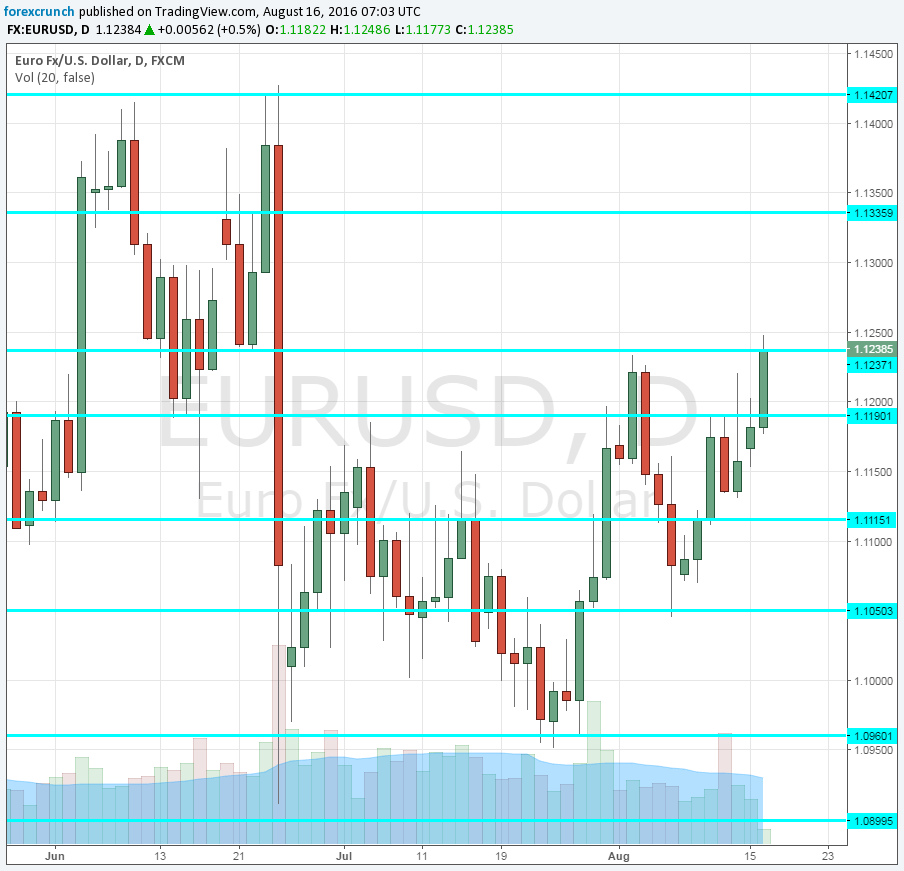

Here is how it looks on the daily chart. 1.1240 is a line of resistance and confirmation is still awaited. Higher above, 1.1335 is the next cap followed by 1.1420, the high seen just before the EU referendum results came out. On the downside, we find 1.1190 and 1.1130.