EUR/USD continues its fantastic week, leaping above another resistance line thanks to the weak US Non-Farm Payrolls.

The pair is now at the highest levels since May 22nd. How far can it go?

The US gained only 96K jobs, worse than the early cautious expectations of 120K and well under the updated expectations. The drop in the unemployment rate to 8.1% wasn’t convincing, as it came on top of a drop in the participation rate to only 63.5%.

So, the expectations for QE3 on September 13th are high in the sky. While these expectations are questionable, there’s less doubt that the details the ECB supplied in its press conference were convincing: unlimited buys of bonds with a maturity of up to 3 years. Spain is expected to complete its part by saying “I do” next week.

EUR/USD

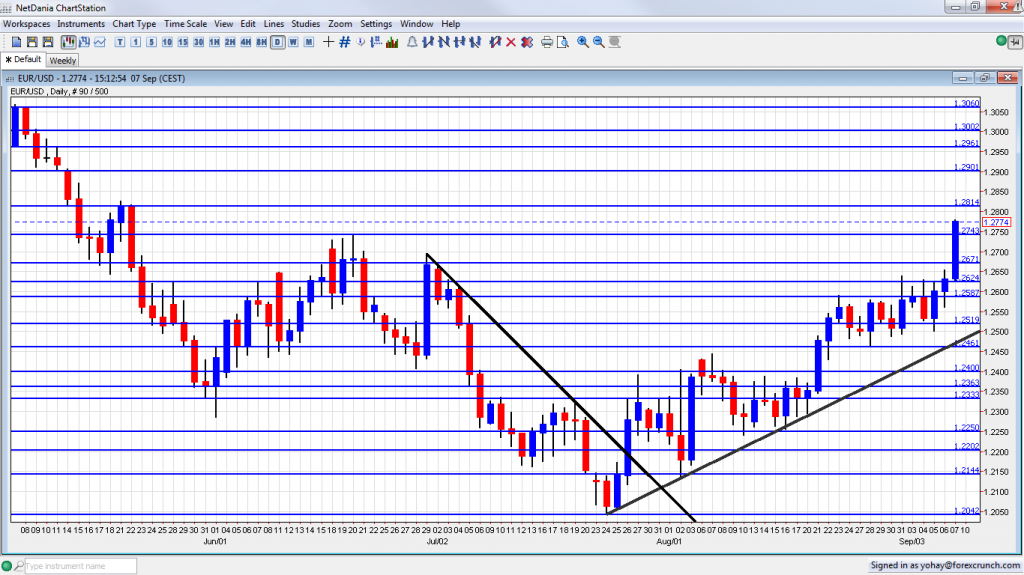

Euro/dollar is now at 1.2775, above the 1.2740 peak seen back in June. The next level is 1.2814, followed by 1.29 and of course the all-important 1.30 line.

1.2740 turns into weak support, followed by a stronger one at 1.2624, which was a triple top.

For more, see the EUR/USD forecast.