The dollar started the week with a nice gap higher as Spanish worries dominated the scene and pushed money towards the “safe havens”: dollar and yen. This gap was closed, as US figures didn’t outshine the old continent nor China.

While retail sales showed nice growth, other figures weren’t that good. Will the bumpiness continue?

The Data

US retail sales grew by 0.8% in March, a nice number and also significantly stronger than 0.4% that was predicted. Core retail sales grew by the same scale of 0.8%, exceeding expectations of 0.6%.

Yet at the same time, the Empire State Manufacturing Index disappointed with a big drop from 20.2 to 6.6 points, much worse than a small tick down to 18.1 estimated by markets. The Philly Fed index published on Thursday usually has a stronger impact as it is for the current month. Nevertheless, March’s soft NY index is worrying.

Business inventories rose by 0.6%, less than 0.7% that was expected. This usually shows that the missing inventory will need to be rebuilt in the future, but now it means that Q1 GDP will be weaker than predicted.

Another sign of weakness came from the NAHB Housing Market Index. It fell from 28 to 25 points, unexpectedly.

Employment and housing remain the soft spots of the US economy, and change isn’t coming so fast.

FX Moves

The US dollar Index closed the gap it started with, and is now falling further down below 79.66. The greenback’s retreat is across the board.

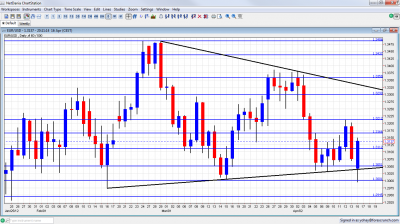

EUR/USD shot back up. From the lows of 1.2995, the pair managed to reach 1.3138 at the time of writing. The pair not only survived the 1.30 line, but climbed back across 1.3050 and 1.3115.

More interestingly, it crossed the uptrend support line it lost earlier in the day, as you can see on the graph.

Tomorrow, we have the German ZEW Economic Sentiment in Europe and the US building permits as the main events.

For more on EUR/USD, see the euro to dollar forecast.