Market favorite Macron is now leading the real vote as well as the exit polls. As the centrist cements his lead, it is time to look at the bigger picture for the common currency.

EUR/USD is already reacting positively in early trading. The pair is trading just above 1.09 as trading volume remains thin. It has peaked at 1.0930, but more players will come in when Tokyo opens, and the full reaction is expected in Europe.

Real vote update – 90% counted

According to the latest count, Macron received around 23.4% and Le Pen is under 22.4%. Around 78% of the votes have been counted. Most importantly, both command a safe distance from Fillon, in third place and under 20%.

Update: with 90% of the votes counted, Macron emerges as a clear winner with 23.7% and Le Pen with 21.9%. Fillon remains under 20%. It’s basically over.

In early counting of real votes, Le Pen led against Macron, but that was based on counting in rural areas. Urbanites backed Macron.

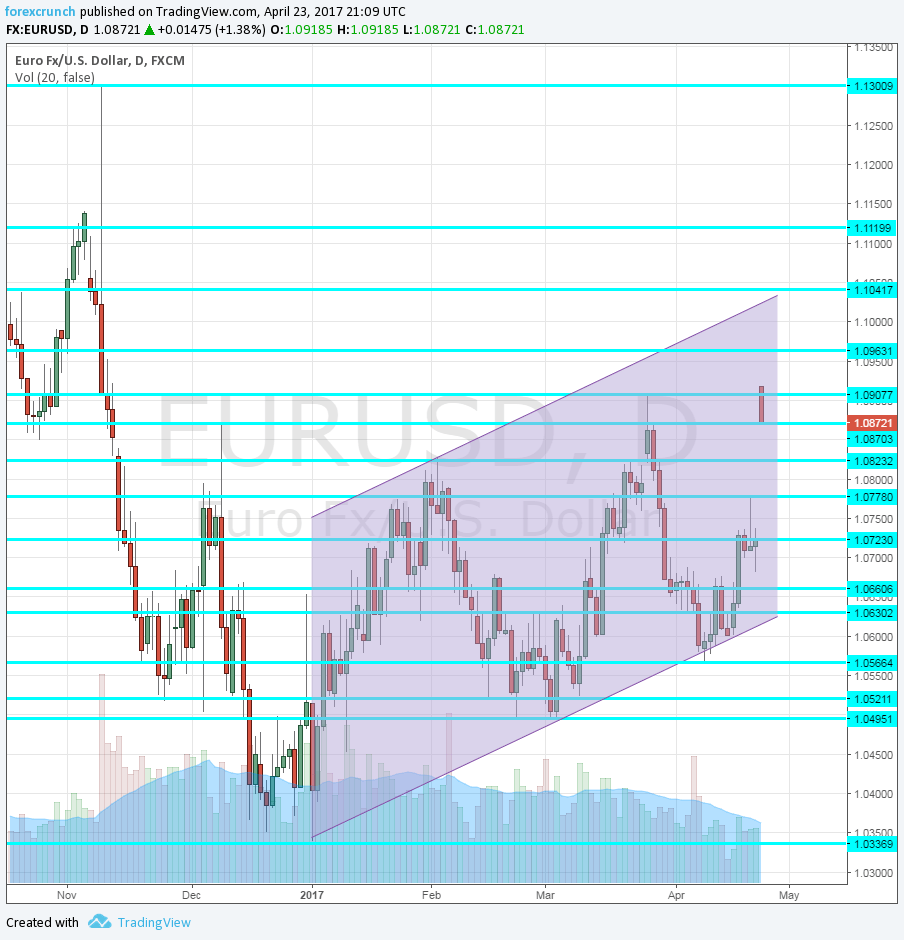

EUR/USD levels

Around 1.09, the pair is at the previous 2017 high of 1.0905 which works as support. The immediate level of resistance is at 1.0960, the low seen in October. The round number of 1.10 is the immediate target, also appearing in our elections preview.

Above 1.10, we immediately find 1.1040, a swing high seen around six months ago. Much stronger resistance is at 1.1120, a level of support when the pair traded on higher ground before the US elections.

The last level of resistance is 1.13, the swing high on election night in the US and also a cap beforehand.

Looking down, we may see a sell-off on a “buy the rumor, sell the fact”. 1.0830 was the high seen in early 2017. It is followed by 1.0775 and 1.0725, close to where the pair closed on Friday.

Here is the daily chart. Note that the pair is now at the upper end of the uptrend channel.