The euro is suffering from the break to Brexit but it could take a pause for some Fed movements. Here is the view from Danske:

Here is their view, courtesy of eFXnews:

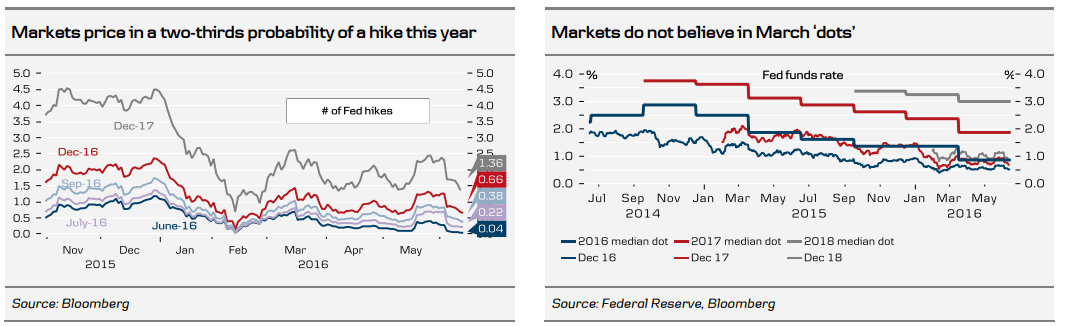

We believe the Fed will adopt a ‘wait and see’ approach. The two weak jobs reports are concerning but it seems too early for the Fed to change its economic outlook significantly at this point. We still expect it to hike in September but risks are skewed towards a later hike as it would require a rebound in employment.

The statement will also recognise that private consumption and housing market data suggest the domestic economy has picked up speed in Q2 after a weak Q1. We think the Fed will repeat that it ‘monitors global economic and financial markets developments closely’ as financial stress has eased and China has stabilised but that the downside risks from these factors remains. It will be interesting to see if the Fed has any comments on oil as prices have doubled since January and are USD10 higher per barrel than at the last meeting in April. The Fed’s main problem is that there is not much data after the weak jobs report – retail sales on Wednesday will be one of the only major releases since then.

Thus, it seems too early for the Fed to change its economic outlook significantly at this point. As we argued in our flash comment after the jobs report sentiment can shift quickly. Last year, the September jobs report was pretty weak, which led us to push our expectation of the initial hike from December 2015 to early 2016 (market expectations were pushed out as well). However, only one month afterwards the October report came out really strong and the Fed ended up raising rates in December.

The market has largely priced out the Fed and we expect the FOMC to be a non-event in this regard. The market is unlikely to significantly reprice the Fed just now with the UK’s EU referendum next week. Instead, we believe that markets will focus on the UK’s EU referendum near term and the negative risk sentiment. We see EUR/USD in the 1.11-1.15 range but see risks skewed to the downside in coming months. The FOMC meeting this week is likely to be neutral for EUR/USD but a Brexit would drive a move lower in EUR/USD as the market would focus on rising political uncertainty in the Eurozone. In case of ‘Bremain’, we expect any rally in EUR/USD to be capped by expectations that the Fed is likely to raise interest rates in September.

On a 6-12M horizon, we continue to expect EUR/USD to rise substantially on the cheap valuations of the EUR and the wide Eurozone-US current account differential. We forecast EUR/USD at 1.18 in 12 months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.