EUR/USD hit 14-year lows after the hawkish hike from the Fed. What’s next? Here is the view from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

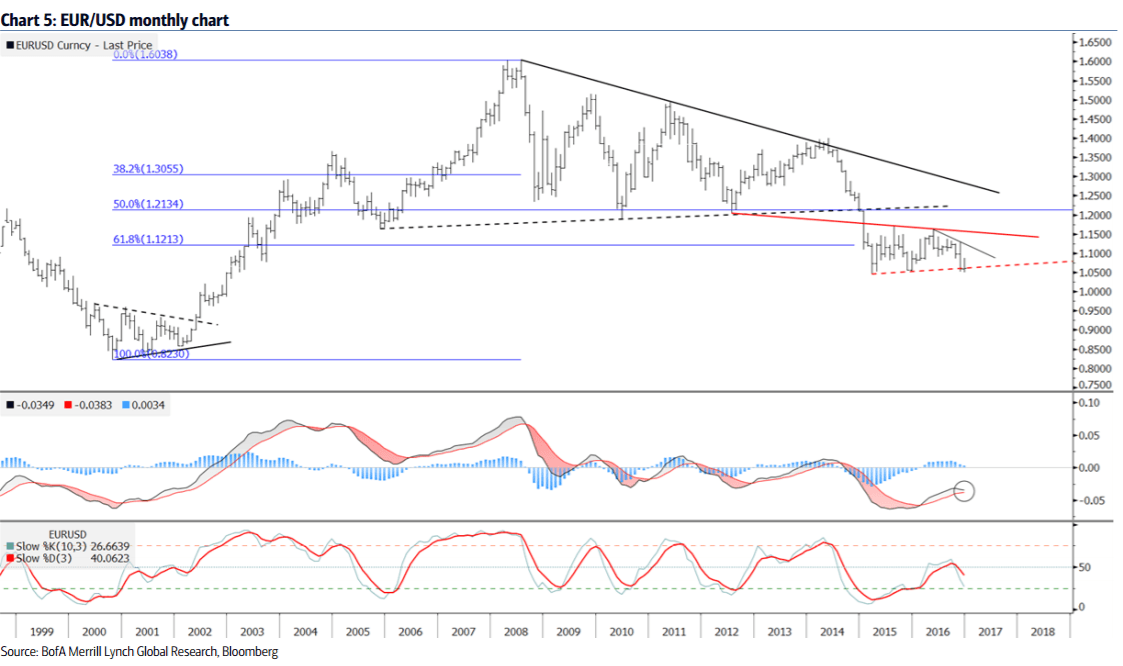

It’s been nearly a year since EUR/USD was trading this low. Last December we had enough technical evidence to go against the grain. However this time it seems more likely that EUR/USD will break down. The break down through major support of 1.0450- 1.05 could be technically devastating for 2017 as it would signal a continuation of the decline since 2014.

It’s clear EUR/USD kept its major technical support in the 1.0450-1.05 area based on the two-year range before this week’s breakdown.

Our daily chart shows a downtrend and a bear flag continuation flag forming that could lead to a sustained break.

This continuation pattern measures lower to 1.0275 and .9980 levels. A measured move based on the height of the Apr-Nov downtrend also suggests EUR/USD could move quite close to parity.

We see MACD rolling over negative and RSI has plenty of room to decline before reaching oversold.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.