The initial US dollar rush seen after the Fed’s hawkish hike was followed by additional waves of greenback grabbing. EUR/USD initially hesitated at the March 2015 low of 1.0462, bouncing back from this line in the sand.

After waiting for a bulk of US figures to come out, the currency ignored the unimpressive data and continued rallying. For EUR/USD, it meant a breakdown of this line.

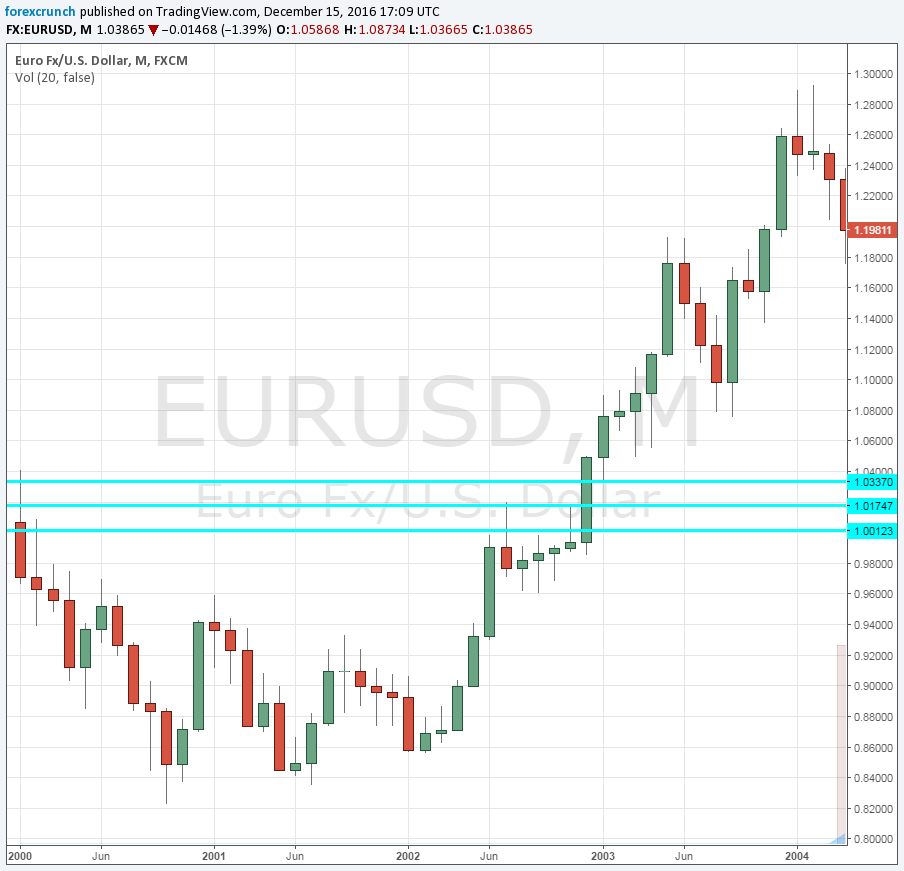

The low so far is 1.0366, around 100 pips below those lows. Euro/dollar is now trading at levels last seen in January 2003, just under 14 years ago, before the Iraq War.

Talk about EUR/USD parity has certainly intensified. If we look only at the recent past, the road is wide open. But if we took a look at the period when the pair battled this round number, we can see two stepping stones on the way.

The road to EUR/USD parity

The first is quite close. It appears at 1.0340, the low seen in 2003, as the pair prepared to push higher. With the volatility, we see at the moment and the antiquity of this line, we can say that the pair survived the initial test. For now, we have a bounce.

The next line on the road to 1.0000 is at 1.0150. The level was seen in mid-2002. At that time, euro/dollar made an initial thrust above parity before being rejected and succeeding later on, in 2003. The 1.0150 level is more significant than 1.0340.

Will the pair continue lower soon? The move may be over-extended for the near-term but could materialize in January 2017.

When liquidity returns after the holidays and as expectations for Trump’s fiscal stimulus rise, the USD could make another push. If parity does not happen in January, a potential disappointment from Trump’s true colors could trigger a bounce before this currency equilibrium is reached.

EUR/USD: Heading Firmly Towards Parity After Technical Breakout – BTMU