EUR/USD seems to trade in a listless fashion, looking for a new direction. What’s next?

The euro is caught at the moment between an improving economic trajectory and populist political trends.

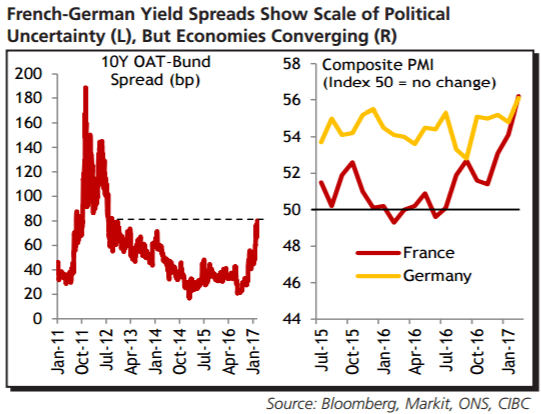

In the short term the latter appears to be winning, with concerns regarding Marine Le Pen’s polling performance seeing French-German yield spreads widen and weakening the euro.

However, on the assumption that she doesn’t win the Presidency come May 7th, markets should then start to focus on the better economic climate. That was signposted recently by the Eurozone composite PMI reaching its highest level since April 2011. And encouragingly, that growth is more broad-based, with France catching up with the normal head of class Germany.

So after a near-term dip, EURUSD should recover to 1.12 by year-end.

CIBC targets EUR/USD at 1.04. 1.07, 1.10, and 1.12 by the end of Q1, Q2, Q3, and Q4 respectively.