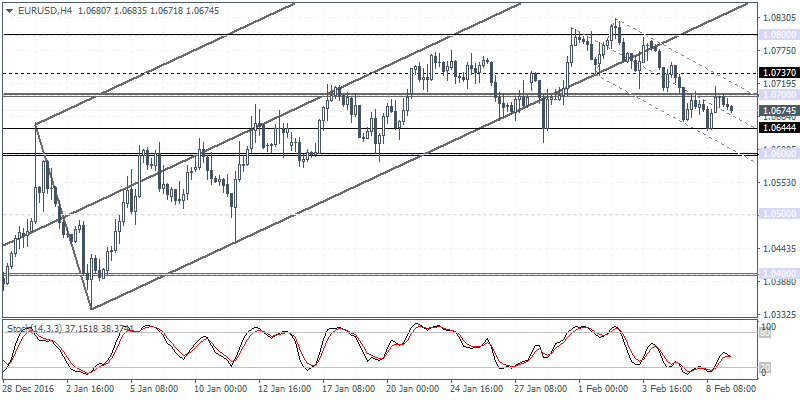

EURUSD intra-day analysis

EURUSD (1.0674): EURUSD attempted a bullish recovery yesterday, but price failed to break out above 1.0700 level thus establishing a resistance level at this point. The downside continuation is likely as the single currency will now retest 1.0644 support which previously offered a bounce in prices. A higher low above 1.0644 could signal a potential retracement back to 1.0737 resistance level on a breakout above 1.0700. Still, EURUSD remains biased to the downside with 1.0600 target in sight.

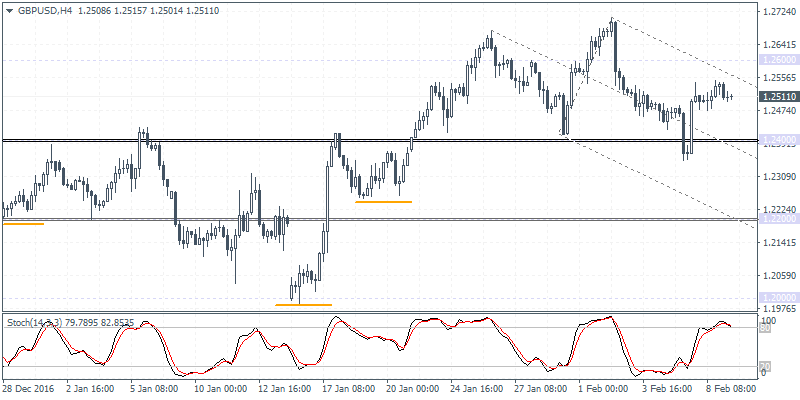

GBPUSD intra-day analysis

GBPUSD (1.2511): GBPUSD was subdued in yesterday’s trading but the price action earlier today suggests the potential for GBPUSD to retest the support at 1.2400, which is proving to be critical price level for the cable. A retest and bounce off 1.2400 could signal a continuation to the upside and would keep GBPUSD on target towards rallying to 1.2800. Market participants were expecting BoE policy maker, Jon Cunliffe to offer some remarks on interest rates after the day before, his fellow policy maker Kristin Forbes said that higher interest rates were needed. Mr. Cunliffe kept his speech focused on the business investment in the UK offering little in terms of policy guidance.

The key event risk for the British pound today will be the speech by Bank of England Governor, Mark Carney who is expected to speak at an event.

NZDUSD intra-day analysis

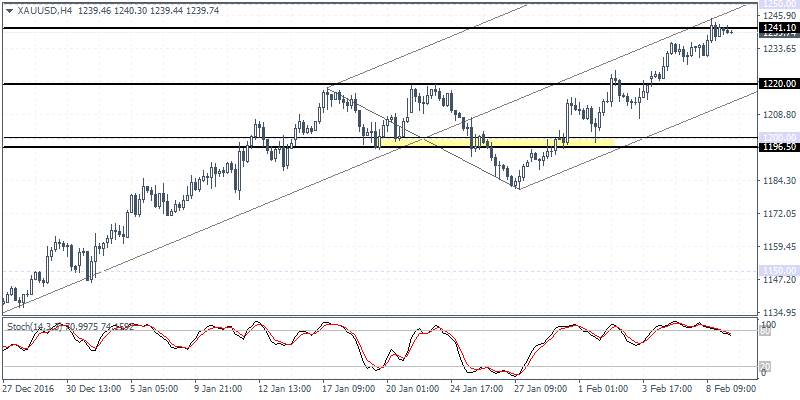

XAUUSD (1239.74): The rally in gold prices look to be nearing its end with $1241.10 resistance so far proving hard to beat since the past five 4-hour sessions. The rally to this resistance comes amid a strong hidden bearish divergence on the daily chart which exposes the support level at $1200.00. However, on the 4-hour chart, initial support can be seen at $1220 ahead of further declines towards $1200.00. Expect to see another attempt in gold to break out above 1241.10 before the correction resume. Alternately, in the event that gold prices break out above 1241.10, the next main resistance comes in at $1250 provided the breakout is convincing.