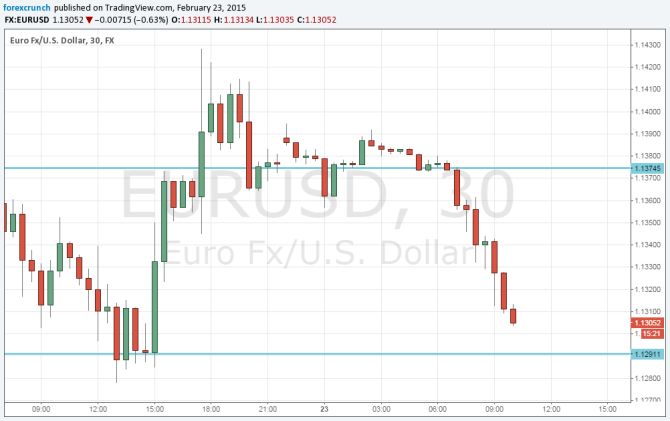

EUR/USD began the new trading week with a gradual and consistent slide to the downside. It fell from the highs but still has room towards support.

Reports coming out of Greece suggest that the government in Athens is not backing down from its red lines regarding the minimum wage, pensions and other heated topics. The list of reforms still hasn’t been officially submitted, but these reports already cause a stir.

Alongside a rejection of some of the austerity measures, these reports also note other sources of raising money: mostly via cracking down on tax evasion. Nevertheless, markets currently think it’s not good enough.

In any case, the crisis is far from over, and there could be additional “cliffhangers”. Greeks have a public holiday today but the Greek government and especially Yanis Varoufakis are very busy.

According to the deal struck on Friday, Greece will get a 4 month extension, but this depends on an approval of reforms. The debt stricken has a deadline: end of day.

Support awaits at 1.1270, a line tested on Friday before the deal was reached. Further support is at the round number of 1.12. Resistance awaits at 1.1373, followed by 1.1460.

Opinion: 3 bearish EUR/USD scenarios for 3 Different Greek Outcomes – Goldman Sachs

Here is how this looks on the chart: