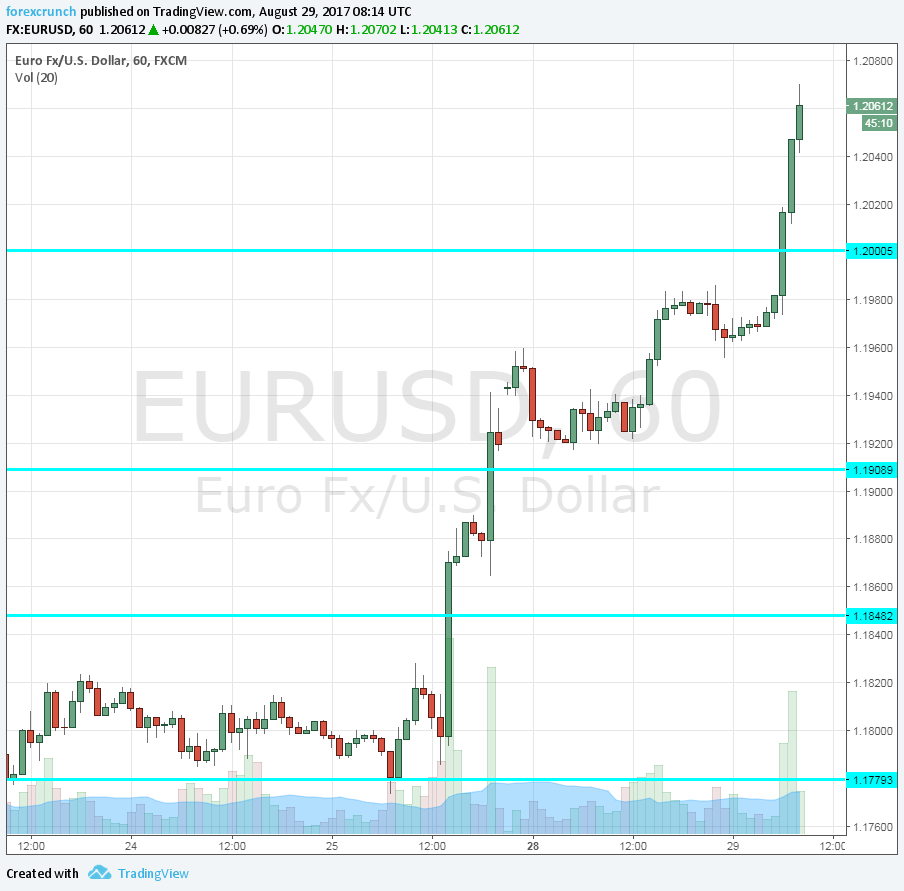

EUR/USD was only gradually getting closer to 1.20, but when it made a move, it was quite significant, to say the least.

EUR/USD is already trading at 1.2067, a gain of around 90 pips on the day. After breaking above 1.20, the pair reached these new levels after an hour and 15 minutes.

On the way, euro/dollar broke above 1.2040. This was the low point July 2012, when there was a risk of redenomination, or in other words: a break up of the euro. Then, ECB President Mario Draghi made his famous speech. He vowed to do “whatever it takes” to do so and added, “and believe me, it will be enough”.

That marked the big turnaround in the pair. Later in 2012, Draghi presented the OMT program (never used) and the pair continued higher, eventually peaking just under 1.40 in May 2014.

Risk off flows?

Apart from the Jackson Hole Symposium speeches by Draghi and Yellen over the weekend, perhaps the euro enjoys some safe-haven flows. The Japanese yen enjoys the firing of a North Korean missile above Japan, but perhaps the euro is enjoying this as well.

Back in mid-2015, the euro played such a role, when the pair advanced on issues with Greece and fell when the crisis was resolved.

Here is how the most recent move looks on the euro/dollar hourly chart: