ECB President Mario Draghi ended his press conference but markets never sleep. He tried not to rock the boat by portraying a “wait and see” mode, but the fresh forecasts don’t really look pessimistic.

Growth has been upgraded by a minimal 0.2% for 2016: from 1.4% to 1.6%. The strong first quarter just cannot be ignored. But this does not lift the forecasts for 2017 and 2018. No change in prospects also for inflation regarding the next two years, something that implies a lower for longer policy.

Assuming the call for governments to do more falls on deaf ears, it is hard to see inflation picking up. Under these conditions, the ECB will eventually be forced to act. When will the ECB act? When there is a slippage of oil prices into core inflation, or as Draghi says: secondary effects.

While he did pat himself on the back and also acknowledged some kind of potential price pressures in Germany, the mediocre core inflation points to a very depressed situation.

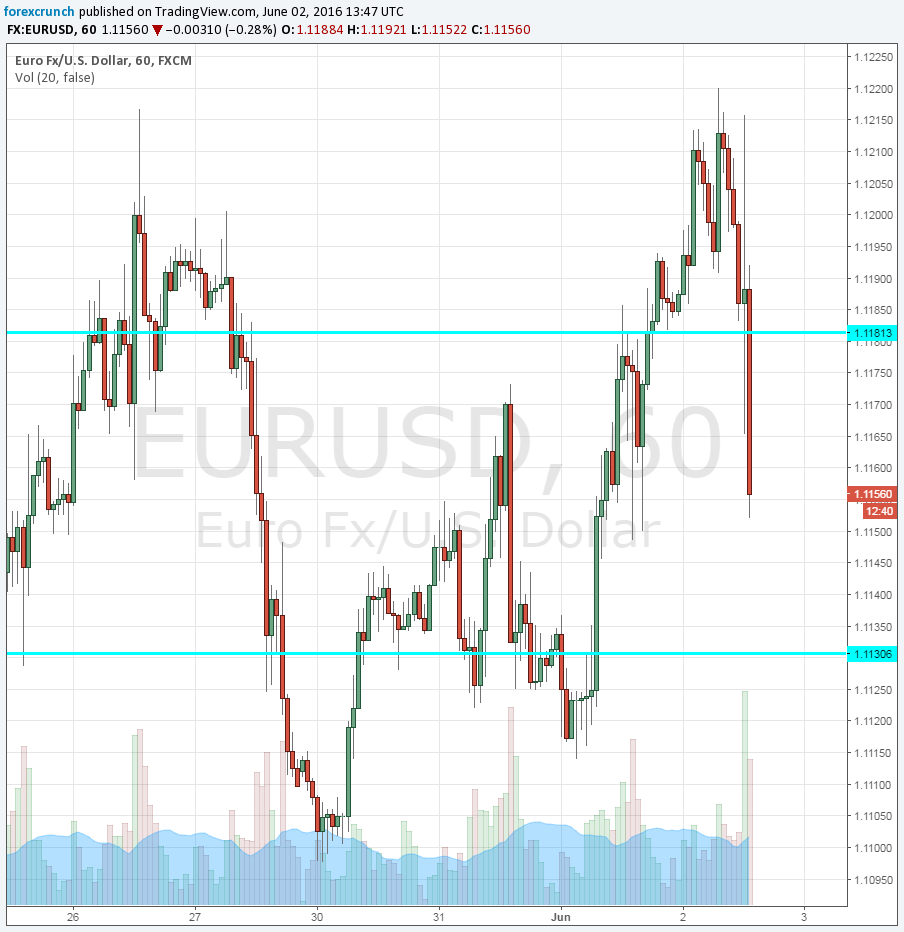

EUR/USD finally reacts in a more meaningful manner and drops nearly 70 pips from the peak. The pair is still in range, but certainly sliding, with 1.1155 at the time of writing, basically erasing the gains seen in recent months. A strong move is seen against the yen with the pair totally crashing to 121.

Tomorrow there’s another big event: the US Non-Farm Payrolls.

See how to trade the US Non-Farm Payrolls with EUR/USD.

Here is the hourly chart of EUR/USD: