The Federal Reserve not only raised rates but also indicated that it is on course to hike them no less than three times in 2017, above two moves predicted earlier.

After the initial dollar rally, the greenback stalled, especially as Yellen downplayed this dot-plot move. However, the narrative that emerged is of Fed hawkishness, a rare feat.

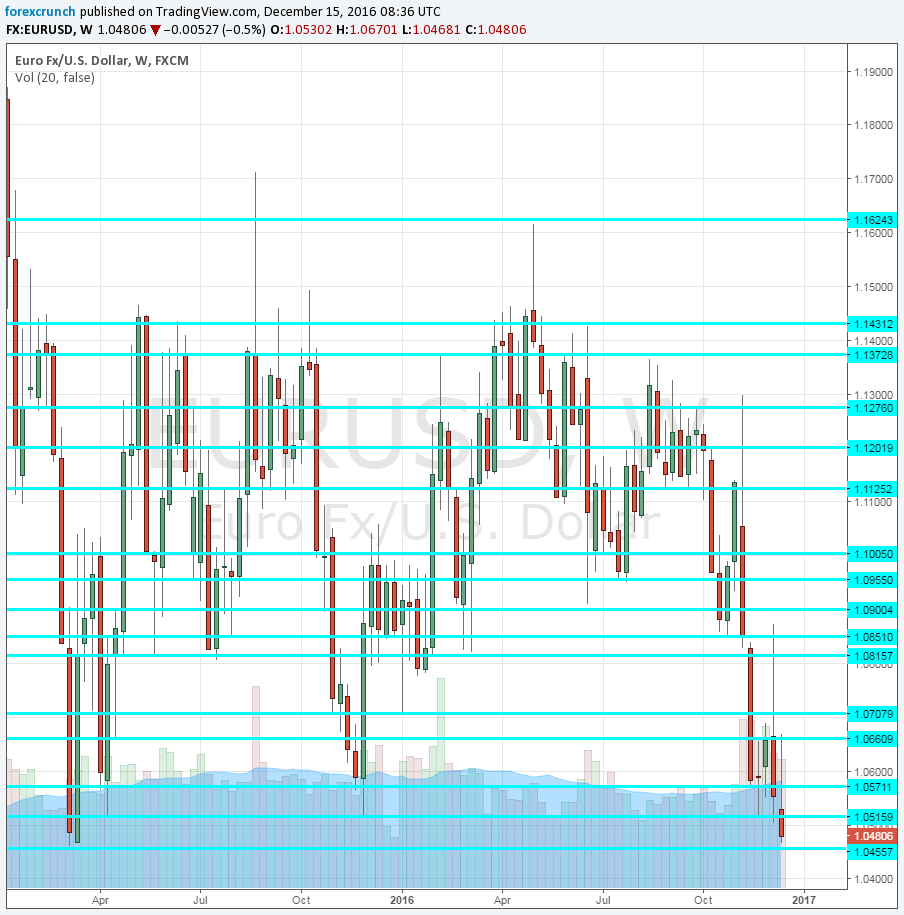

EUR/USD initially stalled at 1.0520, a double-bottom that only saw false breaks so far. However, this time, it’s real. Euro/dollar dropped all the way to 1.0468, just six pips above the March 2015 low of 1.0462. Below this level, we are back to trading last seen in early 2003, nearly 14 years ago.

One can dismiss the change in the dot-plot. In 2015, the FED’s chart showed no less than four rate hikes and ended the year with just one. Nevertheless, the rate hike now and the additional ones awaiting us in 2017 sharpen the difference between the central banks on both sides of the Atlantic. Just one week ago, the ECB showed its dovish hand. It doesn’t take extreme hawkishness from the FED to stand out against the ECB.

What’s next? Will the levee break? So far, the pair has been rejected. But this may not last too long.

More: Sell EUR/USD on rallies – Danske

Here is the chart. Below 1.0460, we can mark 1.03 and already look toward parity. However, this is uncharted territory. On the topside, 1.0520, 1.0570 and 1.0660 loom.