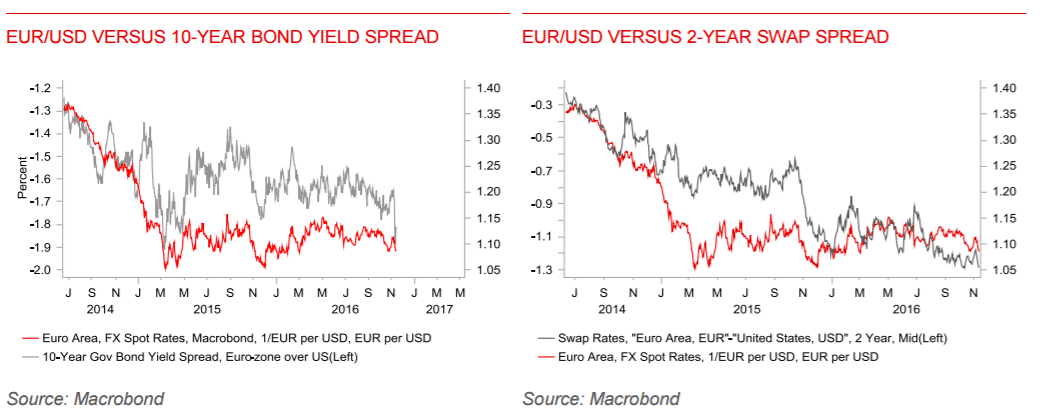

EUR/USD fell to the lowest levels since the beginning of the year. Will it tackle the roundest level of all, parity? The team at BTMU also circles a possible timing for this:

Here is their view, courtesy of eFXnews:

We continue to see upside risks for the dollar since the election victory for Trump as markets continue to focus initially on reflation policies rather than on the more divisive policies related to trade and immigration.

Initial comments & actions from Trump (acceptance speech; some backtracking on Obamacare; soothing words on China relations and choosing a Congressional insider as Chief of Staff) point to the reflation trade fuelled by tax cuts and infrastructure spending continuing and pointing to the need for the Fed to alter communications on policy actions.

A EUR/USD test of parity in the early months of the Trump presidency next year is looking more and more realistic.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.