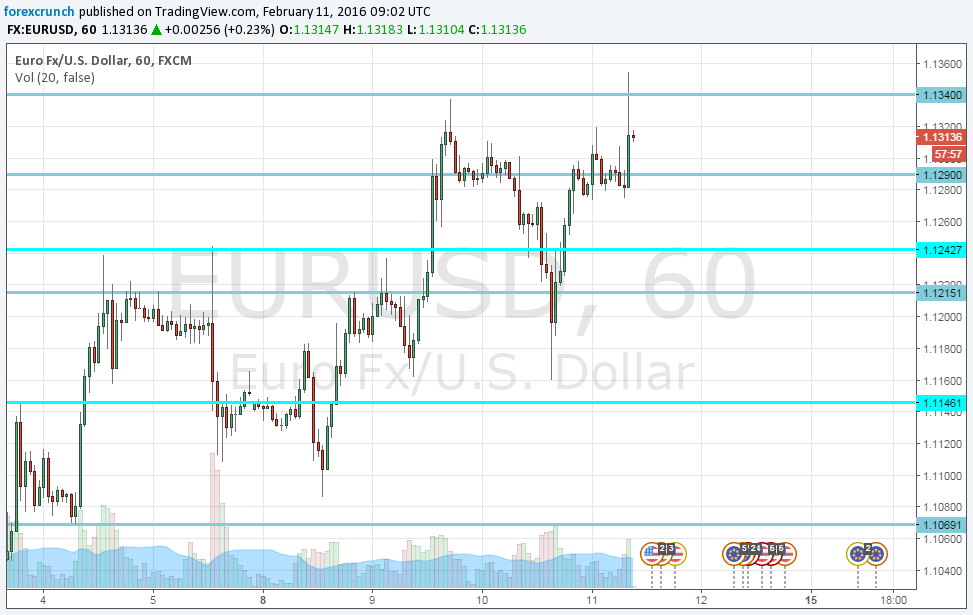

The euro is the second safe haven currency in line. When things get serious, the yen is in high demand at first, and the euro follows. This was enough to send EUR/USD above resistance at 1.1340 to a high of 1.1354, but from there we had it slide back to range: 1.1215 to 1.1340.

Is this the first test before the big thrust to the upside? Or is it one of those infamous false breaks from the world’s most popular currency pair.

The testimony of Janet Yellen yesterday was supposed to be balanced: acknowledging the rout in stock markets but showing optimism. However, it seems that markets have lost hope and respect regarding central banks. This is seen as USD/JPY broke all the lines in the sand for the BOJ despite negative rates and the euro is also causing significant headaches for Mario Draghi in Frankfurt.

So, the atmosphere is negative with oil prices digging into new lows since 2003, stock markets sliding on after the other and the safe havens in demand. All this supports a continuation of the move to the upside: 1.1375 and 1.1460 are the next lines to the upside and EUR/USD is already at the highest levels since October.

However, in these times of near-panic, markets certainly tend to overreact, and this implies a false break and an opportunity to short the pair. Support awaits at 1.1215, 1.1140 and the strong 1.1070.

What do you think?

We still have the second part of Yellen’s testimony beginning at 15:00 GMT. Will she provide more hope, thus pushing EUR/USD down? Or will markets remain damp thus pushing EUR/USD higher?