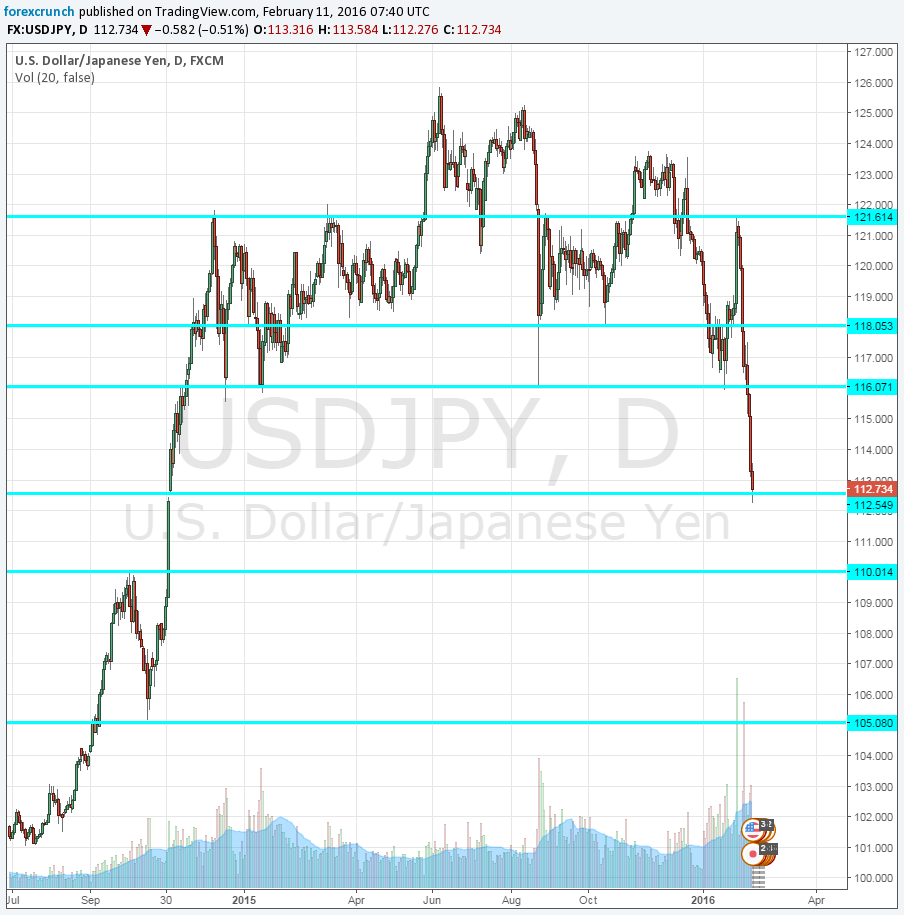

A bank holiday in Japan did not help the Bank of Japan: the ultimate safe haven currency continues to rise and it’s easy to forget that the BOJ set historic negative rates less than a fortnight ago. The pair is feeling comfortable at the 112 handle.

Dollar/yen is basically back to the previous big BOJ decision: in late October 2014 Kuroda announced the second phase of the QQE program, basically pledging more bond buys and at a faster rate. That sent the pair shooting above 110 and crossing 120 quite quickly.

The fall in oil prices, worries about China, worries about individual stocks directly and indirectly related to energy stocks are all sending investors to the funding currency of choice. When the pair last fell and reached 116, the BOJ hinted of action. It resulted in a small rise in USD’JPY to around 118 and once they announced the negative interest rate, we had an immediate reaction all the way to 121.50.

However, the party at the BOJ headquarters was short: a “hangover”, fresh worries and a weakening of the US dollar across the board all sent the yen higher. When 116 was crossed for a second time, we heard about the BOJ “checking prices” – sending out rumors to push the price higher without intervention.

But with also the Federal Reserve joining the cautious stance and talk about oil being dumped on markets, we had a spectacular collapse. Analysts are already talking about 105. What can the BOJ do?

Perhaps they could act in March or when they publish the semi-annual forecasts in April. But what else can be done? Everybody has gone dovish.

Here is the daily chart of USD/JPY, going back all the way to the summer of 2014: