EUR/USD trades at 1.1010, gradually rising within the uptrend channel. The last time it reached these levels was when Macron won the presidency. That move was very short-lived, to say the least. Is this attempt for real? There are good reasons to think so.

Here are five drivers for the recent rise, originating from both sides of the Atlantic. The levels to watch follow.

- Liquidity: This time, the move comes amid significant trading volume and not in the early hours of the Asian session. The pair also has enough breathing room within the range.

- US data has been weak: The drift higher began with the disappointing US data on Friday. Retail sales did not rise as much as expected and core CPI dropped under 2%. The news came on top the shortcoming of US wages in the jobs report.

- Trump scandals: Last week it was the firing of FBI Director Comey and another week brings another issue. According to the Washington Post, Trump revealed sensitive information about ISIS in Syria, the information probably obtained by Jordan or Israel. The weakness of the greenback is more evident against the yen, but it is wide enough.

- Growth in Europe: On Friday we learned that the German economy grew by 0.6% q/q and today we will get the updated euro-zone figure, probably standing at 0.5%. In annualized terms, it is 2%, much stronger than the meager 0.7% seen in the US.

- Hopes for Macron: Returning to the first topic, but tackling it from the political viewpoint rather than liquidity. The new French president has assumed office and nominated a Prime Minister. Édouard Philippe comes from the ranks of the center-right Les Republicans. The young president is broadening is base and enlarges the chances of winning the parliamentary elections. A market-friendly PM is also positive for the euro.

EUR/USD Levels to watch

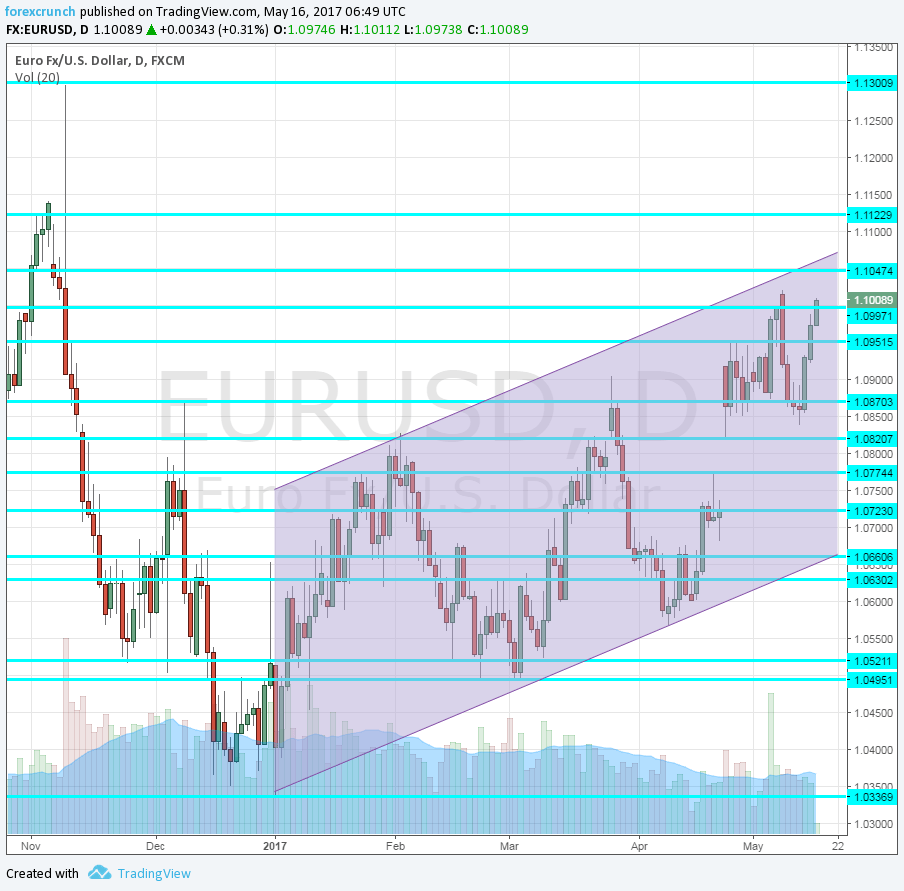

Is the rise above 1.10 holds, the next level to watch is close by: 1.1050, which was resistance back in October. 1.1120 is already a tougher level after serving as stubborn support back in the summer of 2016.

To the downside, we find 1.0950, 1.0870 and 1.0820, the well-known levels.

The uptrend channel now ends at around 1.1080, but a break above the channel cannot be ruled out.

More:

- EUR/USD: ‘Keep The Faith’ In A Decisive Break Higher – NAB

- EUR/USD: the way is up, but not that fast