EUR/USD is looking for a new direction after failing to break to higher ground. What’s next?

Here is their view, courtesy of eFXnews:

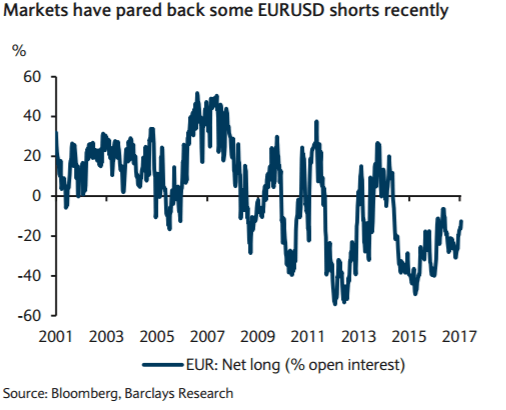

EURUSD appreciated as of late, as softer-than-expected US data, a more dovish Fed and negative headlines on Trump’s policies fuelled further short EURUSD positioning unwinding.

In the near term, a quiet data calendar in Europe and the US is likely to keep EURUSD range-bound amid elevated US political uncertainty but less stretched positioning.

European political risks and monetary policy divergence should push EURUSD lower towards parity later in the year, in our view.

On the data front, we expect German IP to post modest growth at 0.4% m/m in December (Tuesday; consensus: 0.3% m/m; previous: 0.4% m/m). Finally, French IP should contract 0.7% m/m, in line with the consensus (Friday; previous: 2.3%).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.