Monetary policy divergence has been the driving force pushing the EUR/USD lower. Bank of America Merrill Lynch focuses on the key men moving the currencies:

Here is their view, courtesy of eFXnews:

Themes: Trump vs. Draghi

EUR/USD has weakened as the USD has rallied since the US elections. The Euro has not weakened with respect to non-USD G10 currencies and has actually strengthened against the JPY. Strong market expectations for US fiscal stimulus and the Fed December hike with an upward revision of the Dot Plot have supported the USD. US data has been improving, but Eurozone data has also been surprising to the upside recently. The market took well the reduction of the ECB QE monthly purchases, but this one-step tapering suggests to us ECB constraints down the road and positive EUR risks, keeping everything else constant. Looking ahead, the Euro outlook depends on whether the new US President will be able to deliver a sizable fiscal stimulus and at what point markets will start pricing the end of the ECB’s QE program. Hedge funds are short EUR, but real money is not according to our proprietary flows, suggesting balanced risks from positioning.

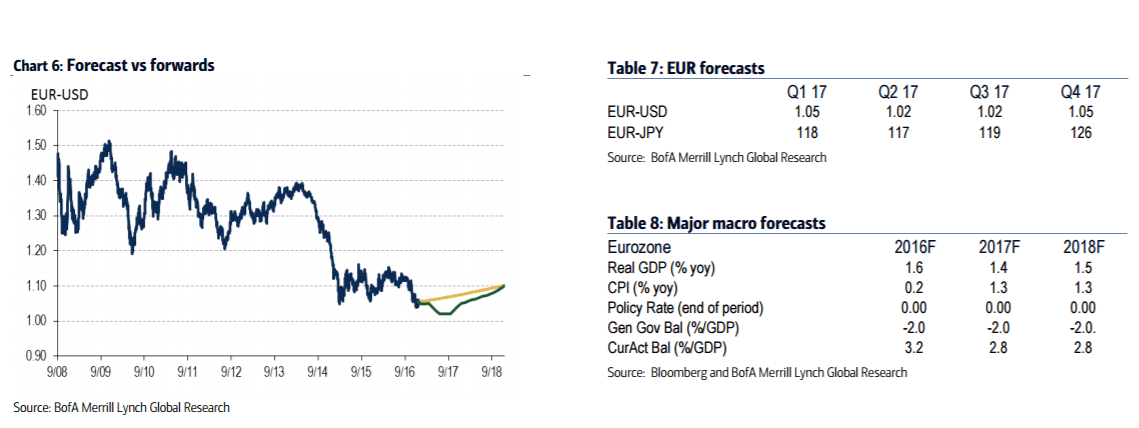

Forecasts: U-shaped.

EUR/USD ended 2016 below our already bearish projections. We now expect it to weaken to 1.02 by mid-2017. Risks to this projection are to the downside in H1, particularly if the US fiscal stimulus is sizable. However, the long USD hedge fund position is stretched and could be squeezed if US data disappoints in Q1. Expecting the ECB to taper QE further towards the end of the year, we see the EUR strengthening in H2, going back to 1.05 by end 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Risks: Many.

Weak US data in Q1 because of seasonality and difficulties to approve fiscal stimulus in Congress could squeeze the USD lower, supporting the Euro. The market could also start challenging the ECB and price QE tapering earlier in the year. However, the French and (if earlier) the Italian elections point to strong negative tail risks for the Euro. In h2, discussions of who will replace Yellen will dominate US headlines, potentially weakening EUR/USD further.