EUR/USD is certainly looking for a new direction after the ECB bounce. What’s next into the Fed?

The team at Credit Suisse weighs in:

Here is their view, courtesy of eFXnews:

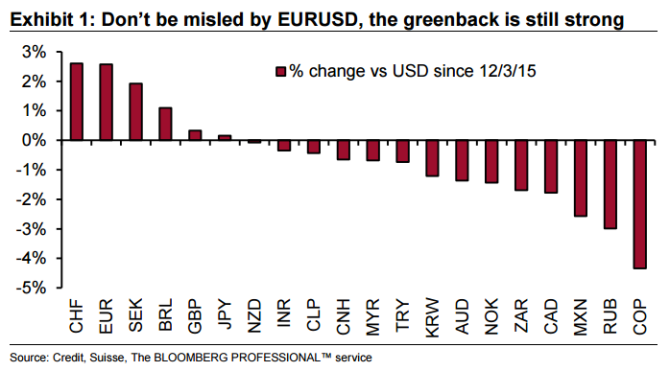

The hawkish ECB outcome – at least relative to where the market felt the central bank had guided expectations – led to EUR jumping across the board, notes Credit Suisse.

“The move clearly wrong-footed the market and led to EURUSD rallying around 4%, from near 1.06 to close to 1.10. This is almost an exact replay of 18 March, when the Fed’s lower dots led to a near-identical outcome,” CS adds.

Where do we go from here?

“EURUSD has now come close to the 1.05 level three times in 2015 without successfully breaching it. This suggests that it will be a tough level to crack without material new information. For example, with a Fed rate hike next week already pricing in, that outcome seems an unlikely catalyst in isolation. As for the upside, we note that euro area inflation breakevens are moving lower again in the wake of tighter-thanexpected monetary policy and the continued slide in oil prices,” CS notes.

“In the summer we focused on this aspect when EURUSD was in the 1.15 region and argued it should act as a break against further strength. We will make a similar argument now and suggest that levels above 1.10 will make the ECB increasingly uncomfortable and prompt it to reemphasize that it can still ease policy again if needed. The question now though is whether it has lost enough credibility and goodwill to see the reaction it would want (lower rates and EUR) to verbal guidance alone,” CS argues.

“Making the assumption that the market will still give the ECB another chance to preserve credibility, we feel EUR rallies towards 1.12 will be sold. The high likelihood of a relatively compressed 1.05-1.12 range holding for a longer period has been instrumental in bringing down EURUSD implied volatility across the board. Our European economists believe that ECB policy will be unchanged from here given that inflation base effects should be supportive in 2016, but leave open the possibility of more easing if oil prices keep falling. Inaction from the ECB until Q2 would also support lower implied volatility,” CS advises.

“Why then do we retain our EURUSD 1.04 3m target? In the main we want to signal that there is still a possibility of a resumed policy divergence debate in that period. Our US economists expect the Fed to hike 25bp next week and then hike three more times in 2016. This pace of hikes is beyond market expectations and leaves room for interest rate divergence even if the ECB stands pat,” CS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.