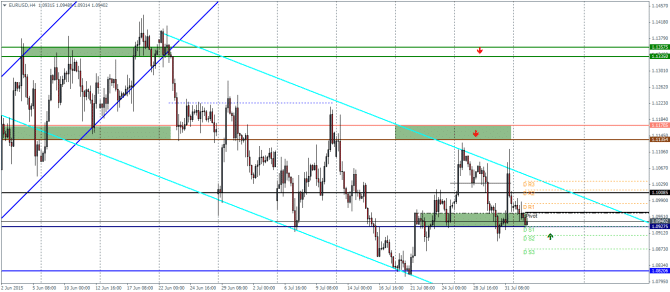

EURUSD Daily Pivots

| R3 | 1.1036 |

| R2 | 1.1015 |

| R1 | 1.0982 |

| Pivot | 1.096 |

| S1 | 1.0927 |

| S2 | 1.0906 |

| S3 | 1.0873 |

EURUSD (1.094): EURUSD is trading near the major support level zone of 1.095 through 1.0925 within the falling price channel. If this level holds, we could anticipate an upside break out from the price channel as the rally could test the resistance at 1.117 through 1.1135. To the downside, if support breaks, EURUSD could snap towards 1.082. Price action has been slow in the EURUSD for the past few weeks but we expect to see some kind of a range breakout in the near term.

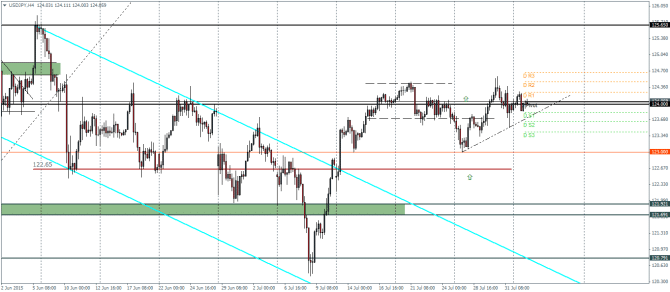

USDJPY Daily Pivots

| R3 | 124.662 |

| R2 | 124.467 |

| R1 | 124.252 |

| Pivot | 124.047 |

| S1 | 123.831 |

| S2 | 123.636 |

| S3 | 123.421 |

USDJPY (124): USDJPY has been trading sideways for the past few sessions and we notice the consolidation near 124 region of support/resistance. Price is still supported by the minor trend line and the bias remains to the upside until this trend line is broken. Technical levels include 125.6 to the upside while 123 is the lower level support that could be tested in the event price breaks the minor trend line.

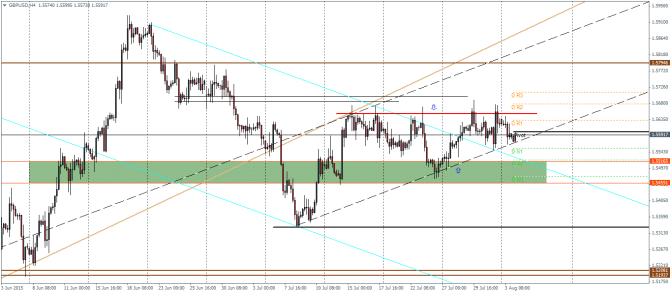

GBPUSD Daily Pivots

| R3 | 1.5711 |

| R2 | 1.5678 |

| R1 | 1.5632 |

| Pivot | 1.5599 |

| S1 | 1.5553 |

| S2 | 1.5519 |

| S3 | 1.5474 |

GBPUSD (1.55): GBPUSD remains range bound within the upper resistance at 1.565 and the lower trend line of the rising price channel. To the downside major support near 1.551 through 1.5455 remains a strong level that could support the declines in the near term. To the upside, GBPUSD will have to break the upper resistance at 1.565 in order to aim for 1.579 level of resistance.