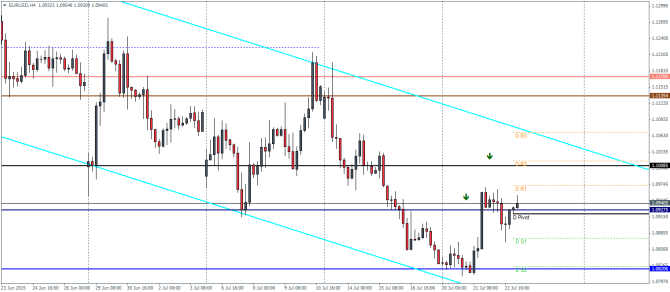

EURUSD Daily Pivots

| R3 | 1.1068 |

| R2 | 1.1016 |

| R1 | 1.0973 |

| Pivot | 1.092 |

| S1 | 1.0876 |

| S2 | 1.0823 |

| S3 | 1.0779 |

EURUSD (1.093): EURUSD bounced off the support near 1.0825 on Tuesday, 21st July and is yet to test higher to establish resistance. On the intraday charts, the price action reached the first area of resistance trading above 1.09275 and it is possible for another leg higher to test 1.10. There is a potential for EURUSD to form a bull flag pattern, which if stays valid could test as high as up to 1.1053. In either case, we wait for EURUSD to test the 1.10 level of resistance. If the resistance holds, EURUSD could resume its downtrend with 1.09275 and 1.082 being the ideal downside price levels that could be broken. Alternatively, if 1.10 turns to support, EURUSD could potentially break out from the falling price channel, in which case could see a test to 1.113.

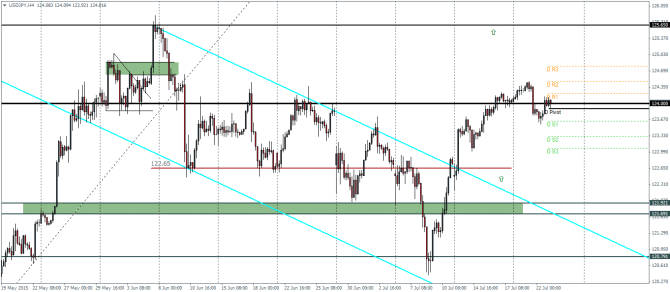

USDJPY Daily Pivots

| R3 | 124.789 |

| R2 | 124.469 |

| R1 | 124.211 |

| Pivot | 123.891 |

| S1 | 123.634 |

| S2 | 123.314 |

| S3 | 123.066 |

USDJPY (124): USDJPY formed a small body candlestick pattern after the bearish engulfing from the previous day. We however remain biased to the downside for USDJPY, with the possibility of a test down to 122.65. Price is seen to be currently struggling near 124 level of support and resistance, making a strong consolidation at this price zone. To the upside, the 125.6 target could be aimed for should prices break above the short term highs at 124.5, failure to do so would however validate the view for a decline to 122.65.

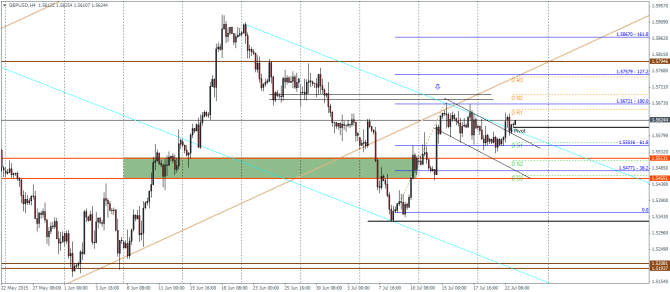

GBPUSD Daily Pivots

| R3 | 1.5750 |

| R2 | 1.5698 |

| R1 | 1.5655 |

| Pivot | 1.5602 |

| S1 | 1.556 |

| S2 | 1.5507 |

| S3 | 1.5464 |

GBPUSD (1.562): GBPUSD, after consolidating for the most part is currently trading out of the falling price channel. But to the upside, prices are likely to be capped near 1.568 through 1.5698. We notice the bull flag pattern formed here, which shows the potential for an upside continuation in prices to target the initial resistance at 1.568 region, following which, a test to 1.58 is likely. To the downside, GBPUSD will find strong support near 1.551 through 1.5455 region. But overall, we expect GBPUSD to continue to push higher.