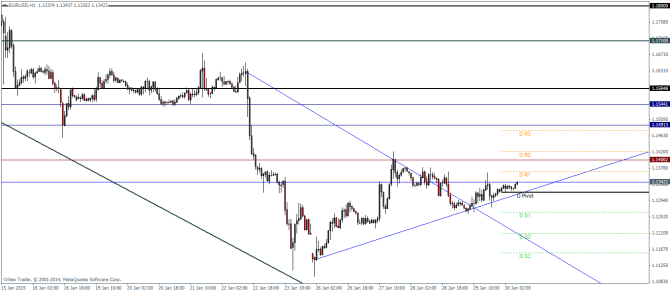

EURUSD Daily Pivots

| R3 | 1.1476 |

| R2 | 1.1421 |

| R1 | 1.137 |

| Pivot | 1.1315 |

| S1 | 1.1264 |

| S2 | 1.1209 |

| S3 | 1.1158 |

EURUSD was weaker yesterday but managed to continue staying above its lows, giving the possible hints that further upside, to testing 1.14 levels cannot be ruled out. Currently, price action has managed to break above the adjusted trend line along with a brief retest. If prices remain above the rising trend line, we could expect an initial test to 1.14, followed by as much as to 1.15 levels. A break of the rising trend line could however put to risk the upside moves.

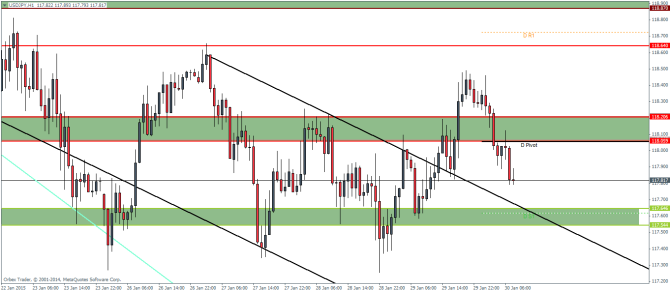

USDJPY Daily Pivots

| R3 | 119.834 |

| R2 | 118.163 |

| R1 | 118.726 |

| Pivot | 118.055 |

| S1 | 117.618 |

| S2 | 116.947 |

| S3 | 116.51 |

USDJPY’s failure to break above the previous high at 118.6 is indicative of a possible move to the downside. However, the next support comes in at 117.646, which if holds, could see some renewed buying pressure in the USDJPY pair. Upside resistance comes in at 118 and 118.2, and only a break of this level will see a test towards 118.6 and potentially 119.

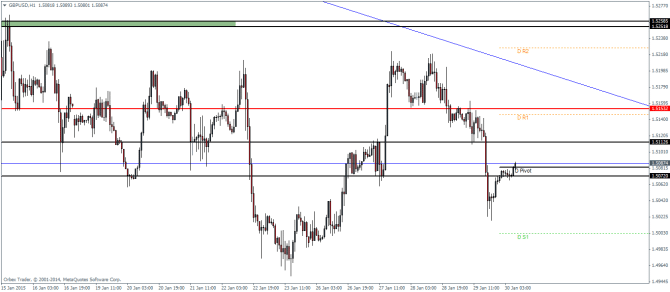

GBPUSD Daily Pivots

| R3 | 1.529 |

| R2 | 1.5226 |

| R1 | 1.5146 |

| Pivot | 1.5082 |

| S1 | 1.5002 |

| S2 | 1.4938 |

| S3 | 1.4859 |

GBPUSD is starting to look weak after the pair failed to hold on to its gains above 1.515 and breaking below 1.511. Price action is currently trading near 1.507, which if holds could see some continued ranging price action. Should 1.507 give way, we could expect a decline to test the previous lows near 1.49 levels.