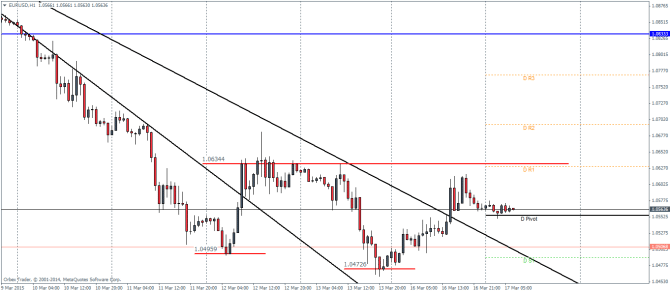

EURUSD Daily Pivots

| R3 | 1.077 |

| R2 | 1.0694 |

| R1 | 1.063 |

| Pivot | 1.0554 |

| S1 | 1.049 |

| S2 | 1.0414 |

| S3 | 1.035 |

From the daily charts, EURUSD managed to form an inside bar on yesterday’s close clearly indicating that prices are consolidating ahead of a big move in the very near term. The hourly intraday charts show EURUSD breaking out from both the trend lines and looks to be currently testing the break out level for support. Upside gains will likely struggle near 1.06344 resistance level. A break of this resistance could pave way for the Euro to rally towards 1.0833. Alternatively, if the resistance holds of if the retest to the trend line break out fails, EURUSD could possibly find some short term support near the trend line before it resumes its further declines.

USDJPY Daily Pivots

| R3 | 121.892 |

| R2 | 121.671 |

| R1 | 121.521 |

| Pivot | 121.307 |

| S1 | 121.157 |

| S2 | 120.936 |

| S3 | 120.786 |

USDJPY continues to consolidate within the triangle pattern, which has been readjusted to accommodate the new lower highs. However, the bias still remains to the upside on a potential break out, indicating the first objective of a rally to 122.4/122.5 at the very minimum. Prices are well supported with the daily pivot level and the medium term trend line which has been supporting prices so far along with the horizontal support line of the consolidating triangle.

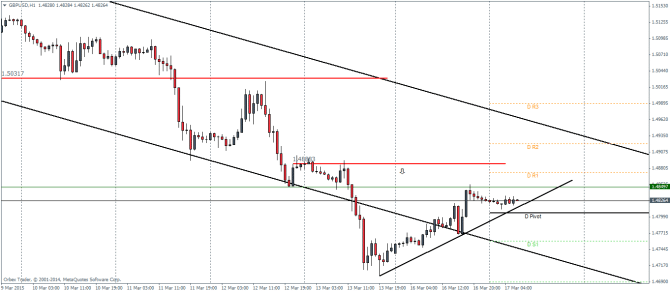

GBPUSD Daily Pivots

| R3 | 1.4989 |

| R2 | 1.4921 |

| R1 | 1.4874 |

| Pivot | 1.4806 |

| S1 | 1.4758 |

| S2 | 1.4690 |

| S3 | 1.4642 |

GBPUSD, similar to EURUSD has formed an inside bar albeit bullish if considering the open and close. Price action has managed to stabilize after setting a new yearly low to 1.4722 last Friday. With price now back within the falling price channel, the immediate rising trend line will be the one to watch. Also noted from our previous analysis, the retracement to the broken support at 1.485 levels is also briefly tested late yesterday. A break out below the small trend line could see the bearish price action resume, although we expect prices to consolidate into the FOMC meeting tomorrow.