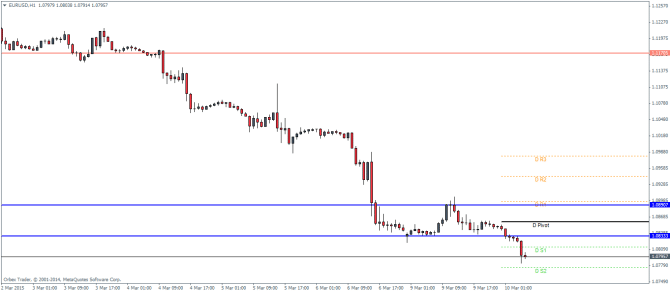

EURUSD Daily Pivots

| R3 | 1.0981 |

| R2 | 1.0943 |

| R1 | 1.0897 |

| Pivot | 1.0859 |

| S1 | 1.0813 |

| S2 | 1.0776 |

| S3 | 1.073 |

EURUSD fell below the short term support at 1.08333. If we see a bounce back to this level to establish resistance, EURUSD could see continued declines, as long as the the short term tip at 1.08907 holds and is not breached. A break above 1.089 would however see a short term rally that could follow but from the current price this idea looks weak. The next major support lies at 1.05068 for the EURUSD if the declines continue.

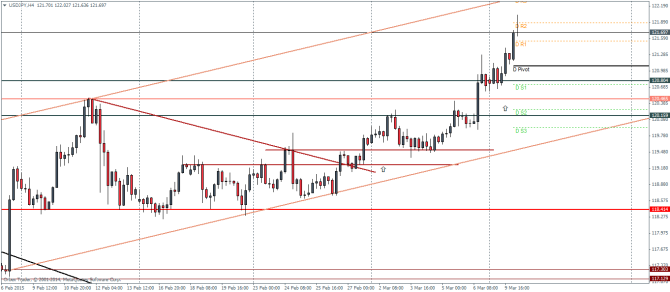

USDJPY Daily Pivots

| R3 | 122.341 |

| R2 | 121.878 |

| R1 | 121.54 |

| Pivot | 121.075 |

| S1 | 120.737 |

| S2 | 120.271 |

| S3 | 119.934 |

USDJPY managed to break above the 120.8 levels noted and looks poised for a rally to 123 – 124 highs. A dip back to the broken resistance at 120.8 could however be on the cards to establish a strong base before the pair pushes along higher. Further below a strong support has been set up near 120.465, so a break below this level will weaken the upside bias.

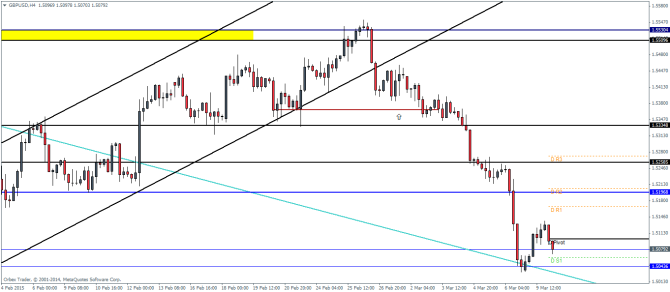

GBPUSD Daily Pivots

| R3 | 1.527 |

| R2 | 1.5204 |

| R1 | 1.5166 |

| Pivot | 1.5099 |

| S1 | 1.5062 |

| S2 | 1.4995 |

| S3 | 1.4957 |

GBPUSD managed a bounce from the lows of 1.5043 but failed to hold on to its gains as the pair currently heads towards retesting these lows. A break below 1.5043 could pave way for continued declines in the pair with the eventual target to 1.4502 levels. On the other hand, if the low at 1.5043 holds, a break above the recent bounce at 1.513 is required to see a rally back to 1.5129/1.52 levels.

In the fresh podcast, we talk about the US economy, the Australian and Canadian rate decisions, a potential easing in Japan, the widening gap within oil prices and an update on forex brokers after the SNBomb

Follow us on the iTunes page