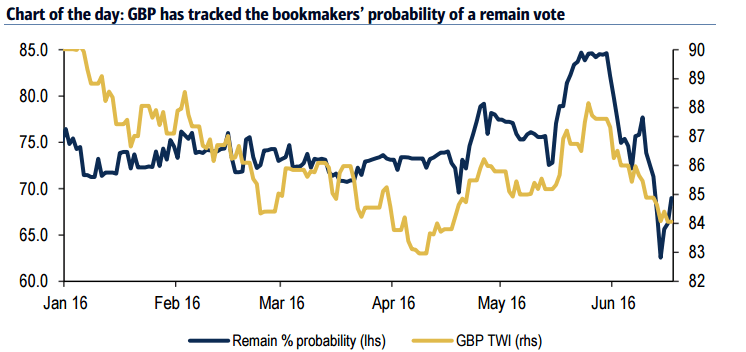

While most of the Brexit focus is on the pound, the euro gets carried away with Brexit talk and the yen is a safe haven currency. Here is the potential impact according to Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

We expect both GBP/USD and GBP/JPY to be the major causalities as Brexit triggers a broader risk-off wave.

Our Japanese strategists believe USD/JPY is likely to fall decisively below ¥100 and is technically vulnerable to a move toward ¥95. The MoF’s intervention probability would increase, in our view.

In our view, a vote to Leave would have a spill-over effect into EUR/USD where an initial 3-5% sell-off cannot be discounted.

Within European FX, CHF is likely to be the main beneficiary as geopolitical risks become more concentrated into Europe.

We would expect further pressure on EUR/DKK, but fully expect the peg to hold as the Danish central bank ramps up its balance sheet. The subsequent reaction in GBP will depend on how quickly the UK government is able to remove the tail risk of protracted uncertainty on the UK’s new trading arrangements. The channel through which this is important will be the funding of the current account deficit and only a speedy resolution to negotiations would lead to a modest GBP recovery. However, in all shades of Leave, we believe there will likely be a structurally lower equilibrium level for the pound.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.