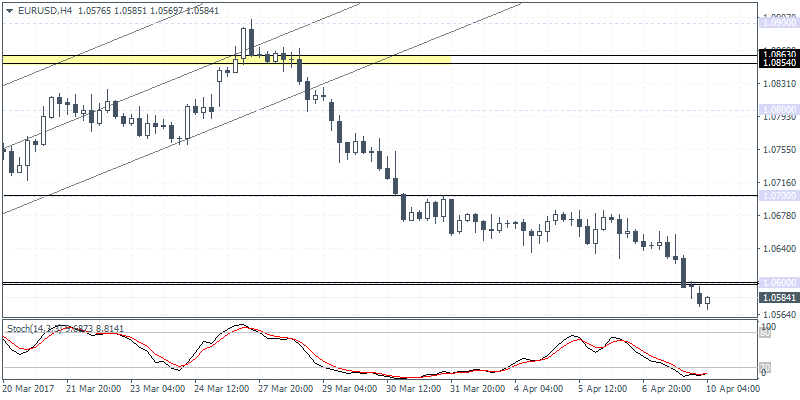

EURUSD intra-day analysis

EURUSD (1.0584): EURUSD opened below the support level at 1.0600, which increases the risks to the downside with the price likely to target the next support level at 1.0500 which was tested on 2nd March.

While the bias remains to the downside, this could change in the event that EURUSD will manage to rally back above the support level at 1.0600. In this instance, we can expect to see a potential retracement that could push the single currency to test the resistance at 1.0700 which was breached strongly without any subsequent pullbacks to this level.

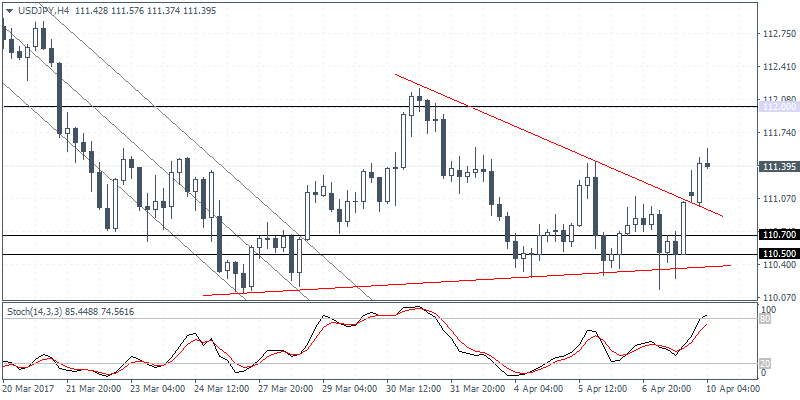

USDJPY intra-day analysis

USDJPY (111.39): USDJPY has broken to the upside from the triangle pattern consolidation. Support has been formed at 110.70 – 110.50 which has been tested multiple times over the past few weeks.

The subsequent rally in prices and the break out to the upside signals a continued bullish momentum that could target 112.00 where resistance is most likely to be established. Alternately, with the Stochastics moving into the overbought level price action could risk another downside in prices which could see the support at 110.50 – 110.70 being tested again

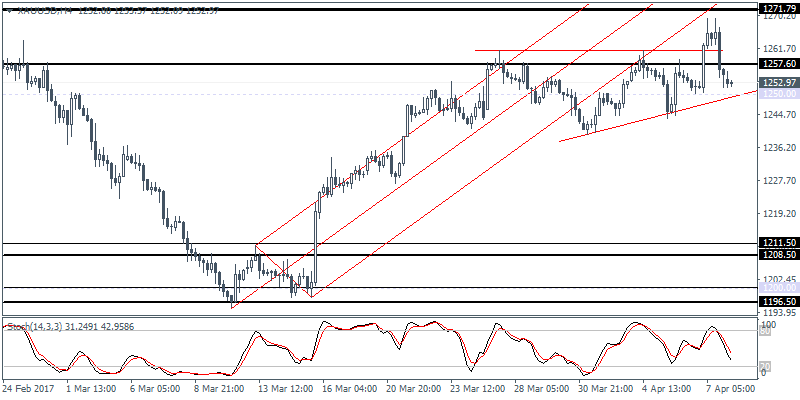

XAUUSD intra-day analysis

XAUUSD (1252.97): Gold prices gave up the gains on Friday with price breaking down below the 1257.60 support/resistance level. The failure to continue to the upside targeting 1271 on the ascending triangle pattern on the 4-hour chart signals a potential correction if support at 1250 is breached. This will indicate further downside in prices which will target the lower support at 1211.50 – 1208.50.

The Fed Chair Janet Yellen’s speech today could be an important event risk for the precious metal, although gold prices could remain volatile, caught between the geo-political developments and the monetary policy forecasts.