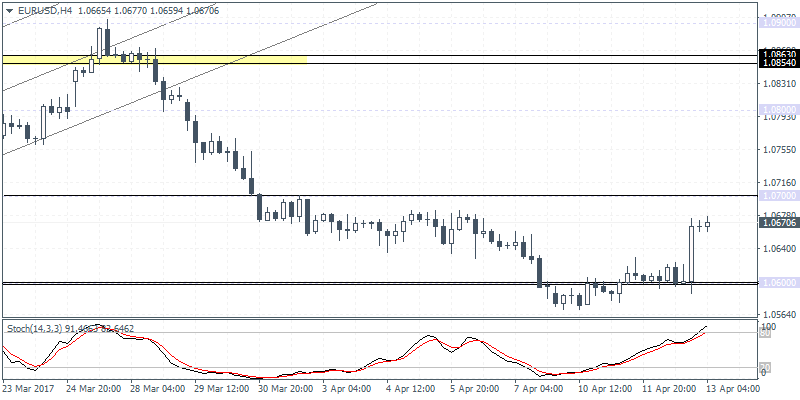

EURUSD intra-day analysis

EURUSD (1.0670): The EURUSD maintained the bullish gains yesterday rising to a 4-day high as price closed at 1.0665. On the 4-hour chart, we notice a slight hidden bearish divergence with the Stochastics oscillator posting a higher high against a lower high in price. This could keep the EURUSD biased to the downside, but supported above the support level at 1.0600. In the near term, in the case of a dip in the short term, we can expect the price to reverse above 1.0600 and attempt to test the resistance level at 1.0700 following a rally to 1.0800.

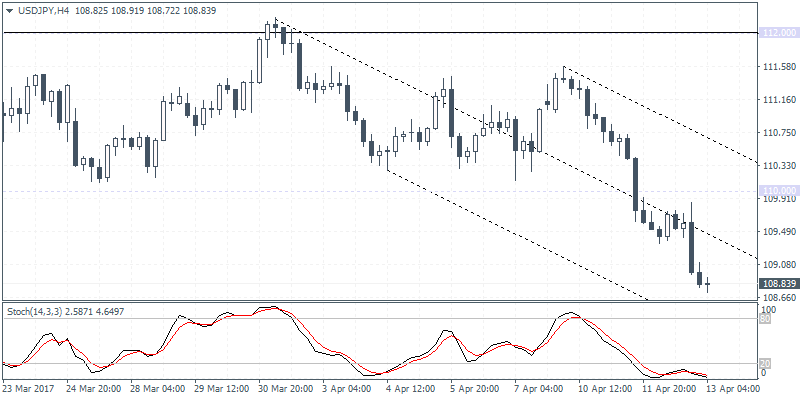

USDJPY intra-day analysis

USDJPY (108.83): USDJPY continues to extend the decline after a brief spell of consolidation. Price action is down two days in a row breaking below the 110.00 support level in yesterday’s trading session. This potentially paves way for further declines down to 108.00. The USDJPY is particularly hit by a risk off sentiment which is seen strengthening the Japanese yen while the U.S. dollar remains week. With no short term catalysts in the near term, USDJPY is expected to remain biased to the downside in the near term, into Friday’s U.S. inflation report.

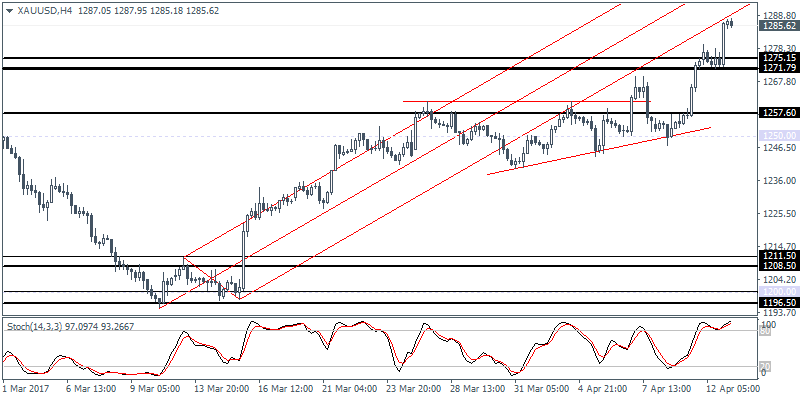

XAUUSD intra-day analysis

XAUUSD (1285.62): Gold is seen currently rallying to a 5-month high as the precious metal has resumed its bullish momentum. This is expected to push gold prices towards the $1300.00 mark once again, and a failure to test this level could trigger a short-term correction in prices towards $1250 initially.

In the short term, the fundamentals are mostly in favor of gold as short-term political events such as the Turkish constitutional referendum, the French elections and the continuing uncertainty in the case of Syria and North Korea continue to see investors rush to the safe haven status of gold.