The euro continues losing ground against the greenback but it could change relatively quickly.

Here is their view, courtesy of eFXnews:

Four arguments for a lower EUR/USD:

“¢ Relative rates: bearish for EUR/USD as the Fed is slightly underpriced for 2018

“¢ European politics: EUR/USD negative but do not overestimate the impact

“¢ Potential border tax adjustments: bearish EUR/USD but the size of the impact is uncertain

“¢ Potential Homeland Investment Act (HIA) 2: bearish EUR/USD but impact likely less than in 2005

Six arguments for a higher EUR/USD:

“¢ Valuation: EUR/USD is substantially undervalued

“¢ External balances: the EU/US CA differential is at the widest level on record

“¢ US politics: Trump is not Reagan

“¢ Eurozone inflation: ECB tolerance for EUR appreciation should rise as inflation has picked up

“¢ US currency policy: the Trump administration appears more concerned about the USD than recent administrations

“¢ US money supply: draw on USD cash buffer and US debt ceiling could support EUR/USD

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

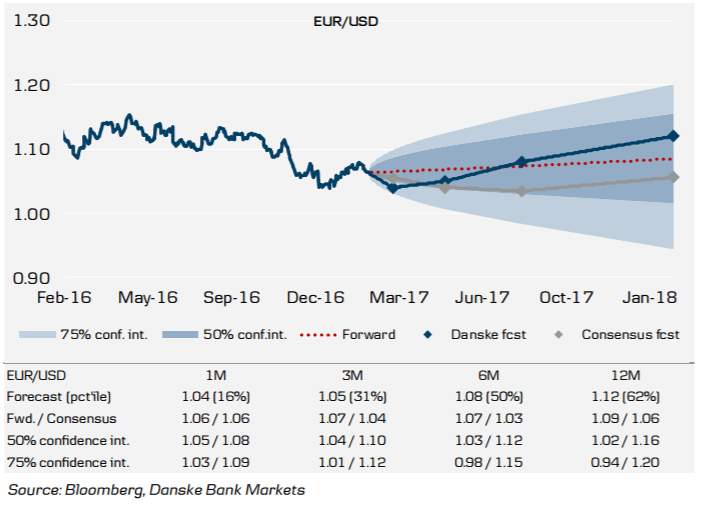

EUR/USD outlook: lower short term and higher medium to long term Short term: moderately lower (1M forecast: 1.04, 3M: 1.05):

We maintain our call that EUR/USD should move lower on a 1-3M horizon, supported by relative rates and our expectations that the Trump administration is likely to announce details in coming months about corporate tax reforms, border tax adjustments and HIA2.

Moreover, we see European politics as a modest EUR negative in comings months and short positioning in EUR/USD is no longer in stretched territory, which should increase the sensitivity to relative rates. We expect that most of the USD positive factors will be priced in over coming months.

Medium- to long-term (6M forecast: 1.08, 12M: 1.12):

In the medium to long term, we are EUR/USD bullish on valuation and the record-high EU-US current account differential, which should drive currency performance over the medium to long term. In addition, we believe that a substantially larger US budget deficit will be negative over time for the USD as US real interest rates will fall.

Some of the factors supporting a lower EUR/USD can also be seen as ‘wild cards’ , as it is not clear if and how fast the new US administration will implement a HIA2 or a new corporate tax regime with border adjustments. Even if implemented, it is not clear that the policies would be a sizable USD positive in 2017. Furthermore, the impact of looming elections in Europe should be short-lived in our base case, where no major eurozone countries leave the euro.

Hence, European politics should not impede a rise in EUR/USD due to fundamentals. Hence, we still project EUR/USD to rebound on a 3-12M horizon, as we see stronger arguments in favour of a higher EUR/USD in the medium to long term.