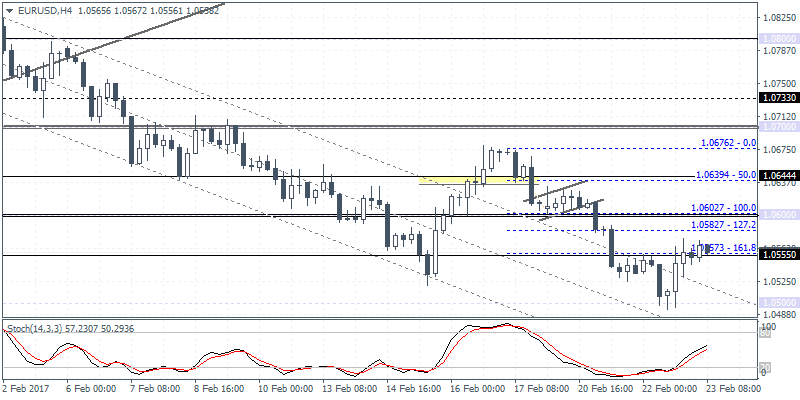

EURUSD intra-day analysis

EURUSD (1.0568): EURUSD closed bullish yesterday after briefly falling to intraday lows of 1.0500 before attempting to pull back higher on the day. The 4-hour chart shows a possible descending wedge pattern that is evolving, which could mean that another decline is possible towards 1.0533, the lows from February 15. A higher low here is required in order to confirm the upside move in EURUSD, which will now target 1.0600, followed by a test to 1.0645. Failure to bounce back above 1.0550 could, however, signal further weakness towards 1.0500.

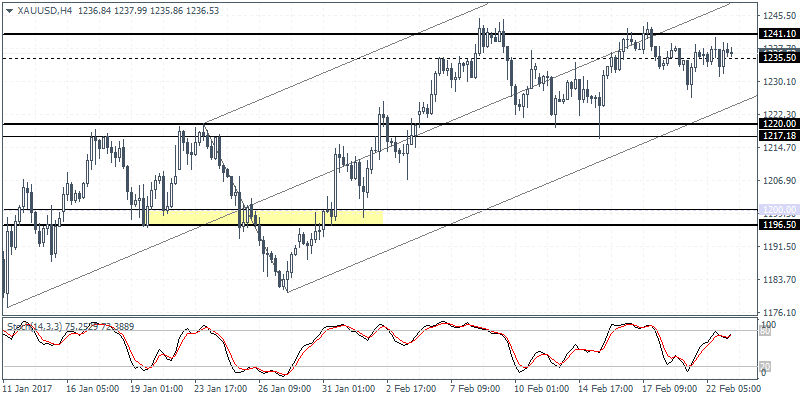

XAUUSD intra-day analysis

XAUUSD (1236.53): Gold prices were muted to the FOMC’s meeting minutes yesterday, and price action has remain stubbornly flat near the 1240 handle for the past six sessions. This nearly flat price action could only mean that gold prices could be preparing for a big move in the coming days. Support to the downside remains at 1200.00, while resistance near 1250.00 are the key levels to watch out for. On the intraday charts, short-term support is seen near 1220 – 1217 region, which could see some short-term bounce if Gold prices slip to this level.

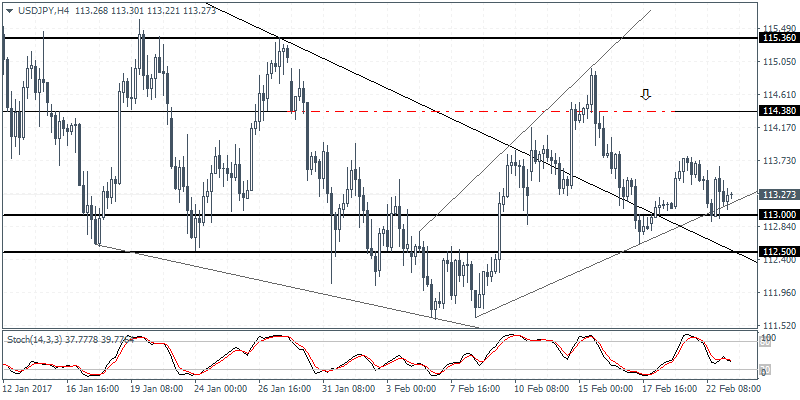

USDJPY intra-day analysis

USDJPY (113.27): USDJPY is seen consolidating within the broadening wedge pattern with attempts to rally being met with resistance. Price action was seen testing 113.00 support yesterday before posting a reversal, but the gains were short-lived. Still, the bias in USDJPY remains to the upside with 114.38 resistance likeely to be tested in the near term. The lower support at 113.00 – 112.50 could continue to keep USDJPY support to the upside, with the bias changing only on a close below 112.50.