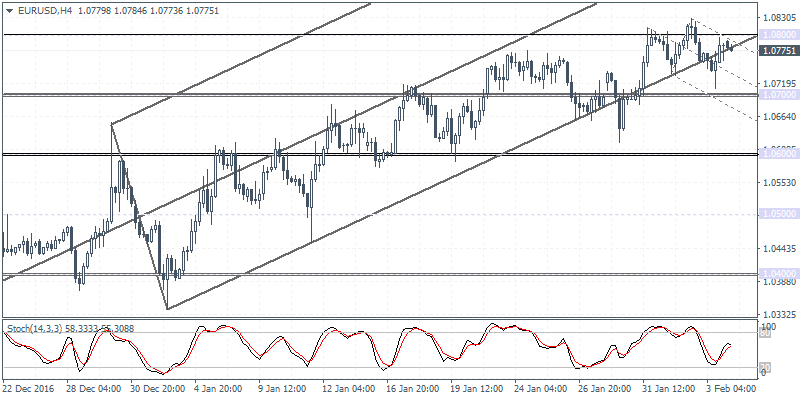

EURUSD intra-day analysis

EURUSD (1.0708): Draghi’s speech alongside weak investor sentiment in the Eurozone saw the single currency come under pressure. Over the week, France’s far-right leader Marine Le Pen officially announced her running for the post of the French president. Ahead of the France elections, the Netherlands will be facing general elections in early-mid March, and the political uncertainty hasn’t been priced into the euro yet. The single currency remained volatile yesterday as EURUSD fell to session lows of 1.0704 but quickly reversed the losses on the day. However, the rally to the resistance at 1.0737 proved hard to break as the single currency is now looking to push lower. Initial support on a breakdown below the round number 1.0700 is seen at 1.0651 – 1.0600 and below this level, EURUSD could be targeting 1.0588.

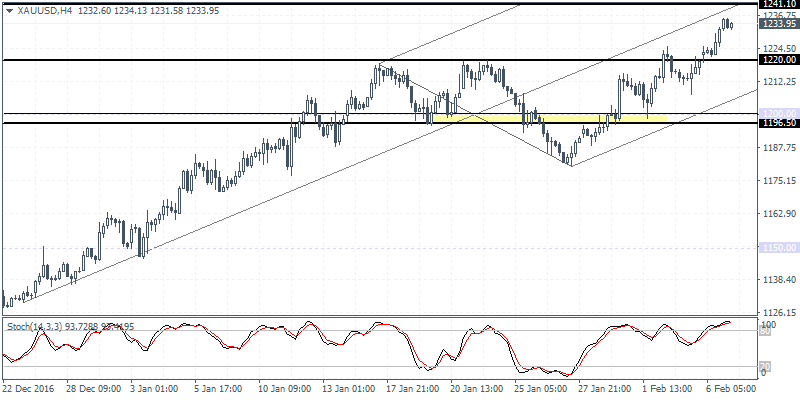

XAUUSD intra-day analysis

XAUUSD (1233.95): Gold prices have continued to maintain the gains and managed to lift off comfortably after a brief dip to the 1200 handle a week ago. The upside momentum could see gold prices target 1241.10, which is the October 7, 2016, lows. A reversal near this resistance will see gold prices likely retreating back towards the new support at 1220.00. There is scope for further upside as gold prices could maintain the bullish momentum which could see 1250.00 coming in as the next target to the upside, provided support is formed near 1220.00. Alternately, a break down below 1220 could, however, signal further correction in gold towards the 1200.00 – 1196.50 support level.

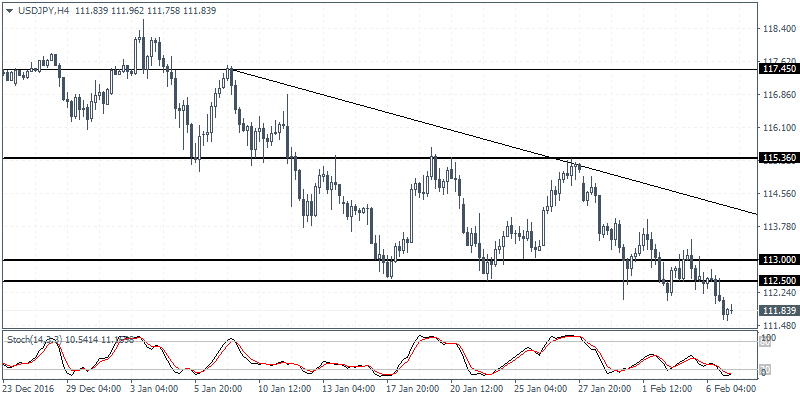

USDJPY intra-day analysis

USDJPY (111.83): USDJPY could be seen pushing lower after price broke down below the 112.50 support which marks the support level of the descending triangle pattern. The current retracement could see USDJPY pare losses and retest the 112.50 where resistance could be established. If considering the descending triangle from the highs of 117.45, then a retest to 112.50 will signal renewed declines in USDJPY down to 109.55 region at the very least. This downside bias could change, should USDJPY close back above 113.00 in which case the falling trend line’s dynamic resistance could be in sight.