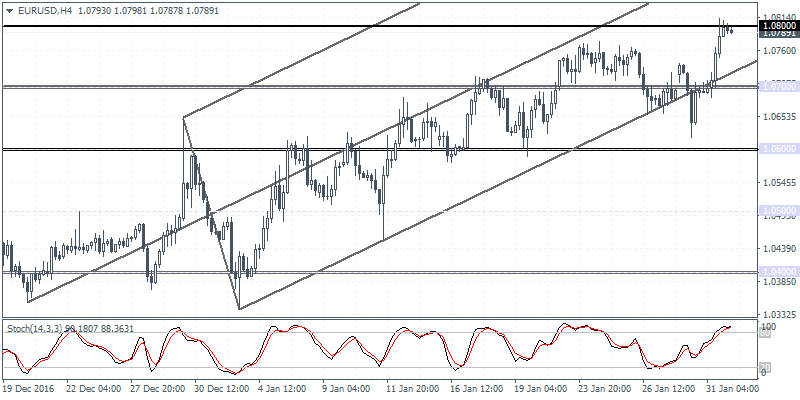

EURUSD intra-day analysis

EURUSD (1.0789): EURUSD posted a strong rally yesterday with price seen reclaiming the 1.0765 resistance level. A confirmed bullish close today could keep the upside bias intact as EURUSD could be seen testing 1.0900 with the potential to maintain further gains. On the 4-hour chart time frame, 1.0800 is now seen clearly as the resistance level. Adjusting the pitchfork, we can see the support levels at 1.0700 and 1.0600, which remain the support levels to the downside in case of a correction. To the upside, look for support to be formed at 1.0800 to ascertain further upside momentum.

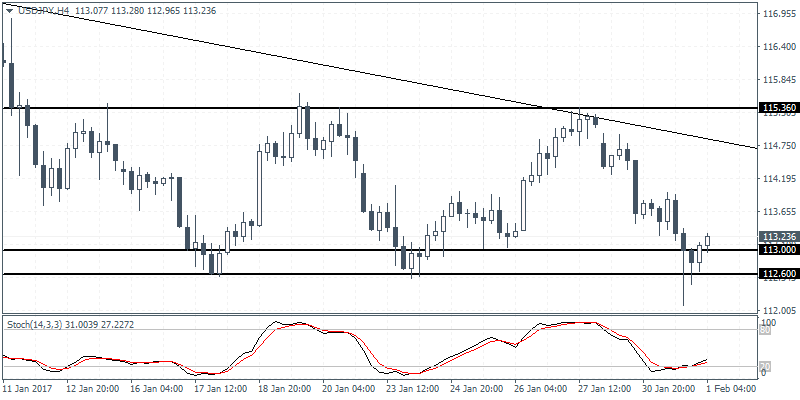

USDJPY intra-day analysis

USDJPY (113.23): USDJPY closed bearish yesterday, but price found support at the familiar price zone of 112.60 – 113.00. This was the price level that has managed to support prices in the previous two attempts where a double bottom pattern was formed. On the 4-hour chart, USDJPY is currently consolidating into a descending triangle pattern. The support level at 112.60 – 113.00 remains critical as a break down below this level could signal further downside towards 111.00 at the very least. The Stochastics on the 4-hour chart is currently near the oversold levels and could signal a short-term bounce higher.

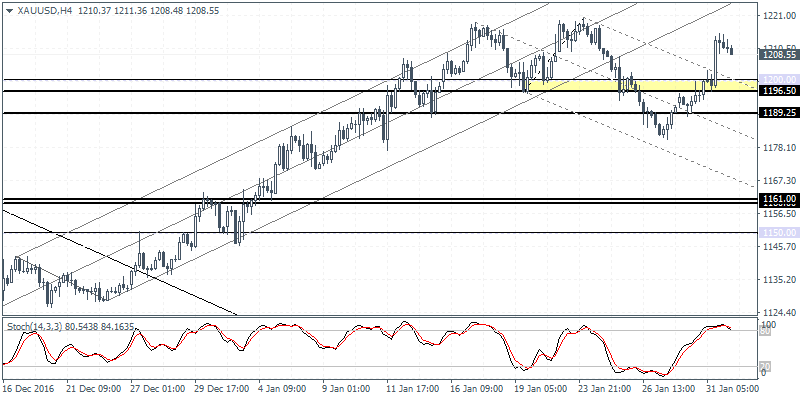

XAUUSD intra-day analysis

XAUUSD (1208.55): Gold prices are likely to dip down to the $1200.00 handle in the near term with the bias turning bullish following yesterday’s strong price action which saw this key price level being breached. With the FOMC decision looming and the central bank likely to stay on the sidelines, gold prices are poised to push higher as long as the support at 1200.00 holds. On the 4-hour chart, we see a hidden bearish divergence which validates the correction to the downside, seen at 1200.00. A breakdown below 1200.00 could, however, signal further downside to come but could keep gold prices range bound within 1190 and 1200.00 handle.