Apart from the upcoming Italian referendum, the month of December is extremely busy. Here is what to expect:

Here is their view, courtesy of eFXnews:

December will be busy for the eurozone, with a heavy economic and political agenda, though we ultimately expect events in the eurozone to matter less for the EUR than developments in the US.

The two main events for the markets are the Italian constitutional referendum on 4 December and the European Central Bank meeting on 8 December.

We think that in both cases, the EUR reaction should be limited and short lived, with US dynamics the primary driver of EURUSD direction.

Italian constitution referendum:

polls show ‘no’ vote is likely Published opinion polls show that the ‘no’ vote is holding on to the lead ahead of Italy’s referendum on constitutional reform. Confirmation of this result would likely see the EUR open broadly weaker in Asia on Monday (5 December), but we think the impact would be relatively limited for several reasons.

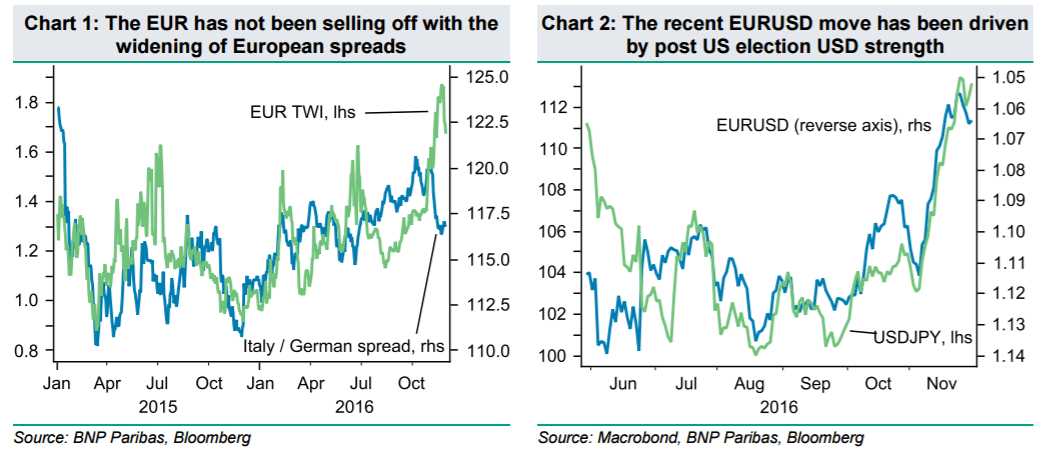

More generally, we do not think FX is the most exposed asset class to potential European risk. A telling example is the Greek debt crisis in the summer of 2015. Unlike during the 2010-2012 European debt crisis, the EUR did not experience a large sell off; in fact it even showed a positive relationship with peripheral spreads (Chart 1). The EUR has been used as a funding currency for FX carry trades and the risk-off environment has forced the unwind of these trades, leading investors to buy back the EUR. The EUR remains supported by a large current account surplus and grounded in strong FX fundamentals.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

ECB December meeting is moderately bullish for the EUR.

Our economists expect the December ECB to announce that it will prolong quantitative easing by six to nine months and scale back its asset purchases from EUR 80bn to EUR 60bn per month. We think this announcement will be moderately bullish for the EUR and do not expect a very large market reaction, as our rates team does not expect a significant rise in rates. Despite scaling back its asset purchases, the ECB should keep a dovish tone.

Firstly, the accompanying statement will be key; ECB President Mario Draghi will be likely to present this reduction as a marginal change and highlight that the policy continues to be exceptionally accommodative, while playing up the economic rationale for such action.

Secondly, he will likely emphasize that special circumstances forced the ECB to increase the run-rate to EUR 80bn a month at the beginning of 2016 are no longer present. Lastly, the ECB is facing a trade off between the eventual length of its programme and the pace of purchases; a scale down will allow the programme to run for longer and end in a more gradual way. With the reduction of asset purchases, we remain cautious on extending EUR shorts too aggressively into December.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.