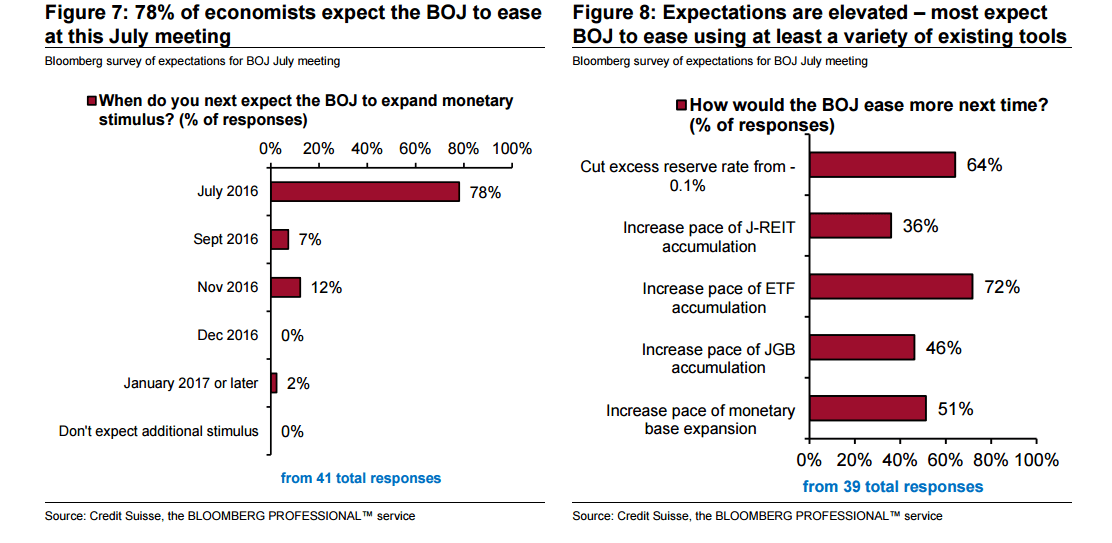

Speculation about action from the BOJ has already triggered high volatility And now it’s their time to speak up. Will they act?

Here is their view, courtesy of eFXnews:

CS’s Japan economics team is not expecting much this time round. They are skeptical of the “helicopter money” thesis based on the view that it is legally difficult to pull it off – they point to Article 5 of the Public Finance Act in this regard.

They also think that further tinkering with existing tools will not add much either. Instead, they argue that eventually, a medium-term monetary-fiscal “accord” will materialize, but that the complications that this generates may mean the market has to wait some more months for it to be ironed out. The type of measures they are looking for in this context include long-run targets for BOJ JGB holdings, a more aggressive and flexible inflation target and a BOJ commitment to roll over maturing JGB holdings in the primary market.

The net result of our economists’ views would be a near-term disappointment for USDJPY bulls followed by longer-term joy once the new, revolutionary framework is eventually introduced.

Certainly, this view is not at odds with our current USDJPY 3m 100 and 12m 95 forecast profile – we have taken the approach that we prefer to see action, not words before reconsidering this outlook.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.