The FOMC meeting minutes were relatively upbeat, seeing the glass half full regarding the economy, but the dollar failed to rally. When will we see the next hike? Here are three opinions:

Here is their view, courtesy of eFXnews:

FOMC Minutes: We Still See 2 Hikes In June And December – Danske

As expected, we did not get much new from the FOMC minutes, as many FOMC members have already expressed their views since the meeting, not least Fed Chair Janet Yellen in connection with her semiannual hearing in Congress.

The FOMC members think the economy continues to improve but that Trumponomics make the outlook more uncertain. ‘Uncertain’ was mentioned 14 times in the minutes (versus 15 in December despite the hike and just five in November).

Although ‘many participants’ expect a hike ‘fairly soon’, only ‘a few participants’ expect a hike ‘at an upcoming meeting’. This supports our view that a March hike is unlikely. The Fed can afford to stay patient for now due to the strong USD, which puts downward pressure on import prices, and PCE core inflation, which continues to run below 2% target.

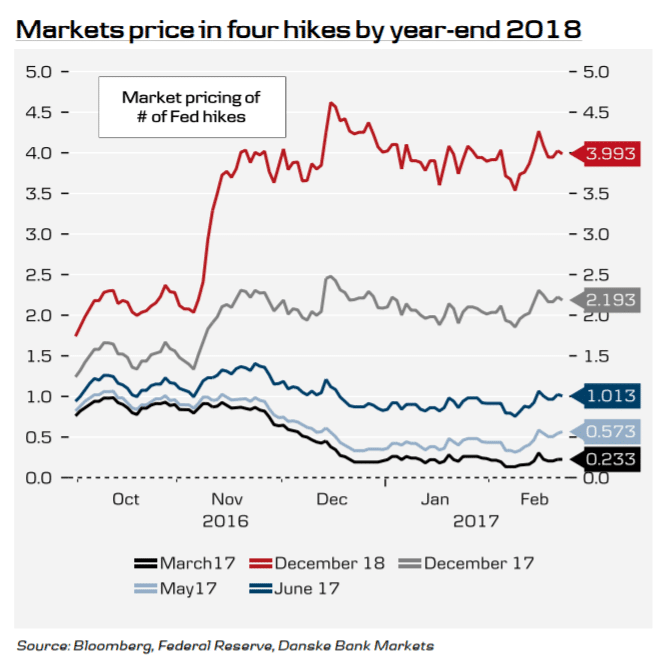

We still expect the Fed to hike twice this year (in June and December) with risk skewed towards a third hike. If economic indicators continue to be strong and we get more information on Trumponomics, we cannot rule out a May hike.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

FOMC Minutes: Wording Still Consistent With A March Hike – CIBC

It was a very plain statement, but there was a little more flavour in the minutes to hint at what policymakers need to see before raising rates again.

Indeed, the minutes showed that many officials saw another hike “fairly soon” as long as the economy remained on track. That’s a stronger hint that a March hike could be coming than anything included within the statement itself, although some may interpret “fairly” as just meaning some time before mid-year. Several officials saw unemployment undershooting what they would expect to be a level consistent with full employment, and only a few still saw downside risks to inflation. Having said that “many” noted only a modest risk of a future overshoot in inflation. The minutes suggested that the committee will start to discuss the size of the Fed’s balance sheet at upcoming meetings, while starting next month the Fed will publish fan charts of uncertainties regarding their economic projections.

Markets are judging the minutes as slightly dovish with bond yields and the US$ lower, however we think that the wording is still consistent with a March hike particularly should earnings growth pick up again in the next payrolls report.

FOMC Minutes: March Clearly On The Table But We Still See Next Hike In June – SEB

After the fed funds rate was raised by 25bps to 0.50-0.75% at the December meeting the FOMC voted unanimously to leave monetary policy unchanged at the first meeting of the year, a decision that was widely anticipated. The statement from the meeting was almost the same as in December. However, one sentence had been added where the FOMC highlighted that measures of consumer and business sentiment “have improved of late”. Probably one way to signal that upside risks to growth had increased slightly.

Overall we regard the message in Minutes as slightly more hawkish than the statement following the Jan/Feb meeting and recent communication by the Fed Chair a week ago.

A March hike is clearly still on the table, which also would increase the probability for three hikes this year. Given the fact the Fed has been very cautious in tightening monetary policy while there are few signs of an accelerating cost pressure we, however, think it is a little too early to change our call on the Fed already now.

Therefore we maintain our forecast of two rate hikes this year for now, with the next one in June. However, we will follow closely all future communication from committee members and consider a March rate hike if there are additional signals going in the same direction.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.