The Federal Reserve opens the door to rate hike in March by saying it can happen “fairly soon”. This is data-dependent and not a commitment. Nevertheless, the members of the FOMC are relatively positive. The document joins public appearances by Fed officials such as Harker and Powell which say that March is on the cards outright.

Nevertheless, the greenback fails to gain. Against some currencies, the USD is unable to extend its gains, while against others, the buck is just stuck.

Here are the words from the minutes that should have sent the dollar higher:

many participants expressed the view that it might be appropriate to raise the federal funds rate again fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations or if the risks of overshooting the Committee’s maximum-employment and inflation objectives increased.

In addition, many Fed officials saw a modest risk of significant inflation and they judged that the Fed would have ample time to react. This is slightly less hawkish. On the other hand, they agreed that discussions about squeezing the balance sheet should begin. This is due for a later stage in the tightening cycle, but this stage is getting closer.

Maybe the dollar didn’t like the fact that “several” saw risks with the possible appreciation of the US dollar. However, this is not new.

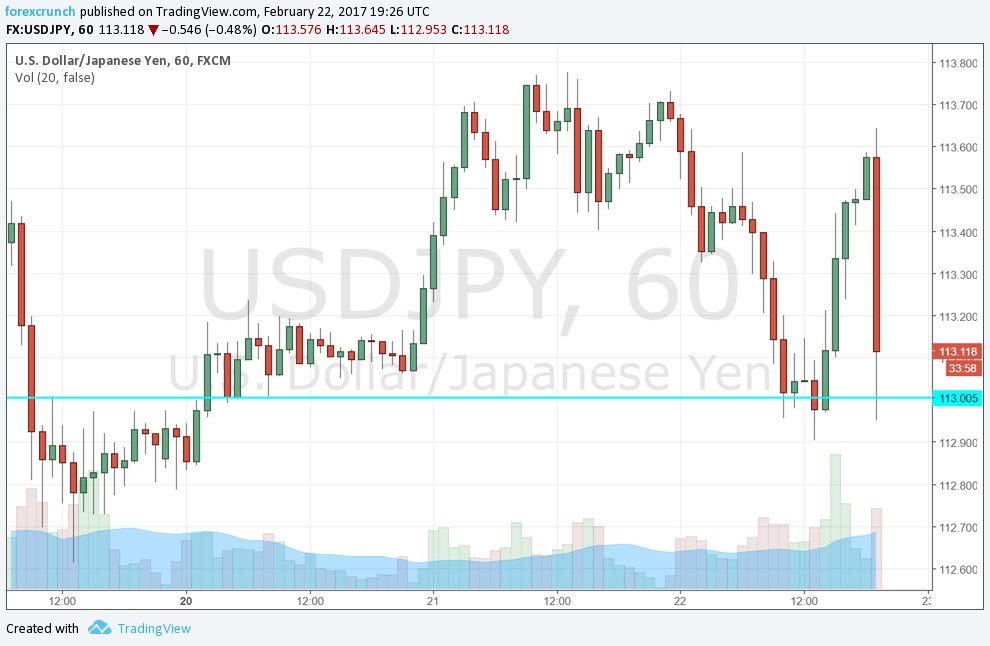

Here is how the USD/JPY looks. Note that the pair is actually dropping. Against the euro, the dollar is fairly balanced.